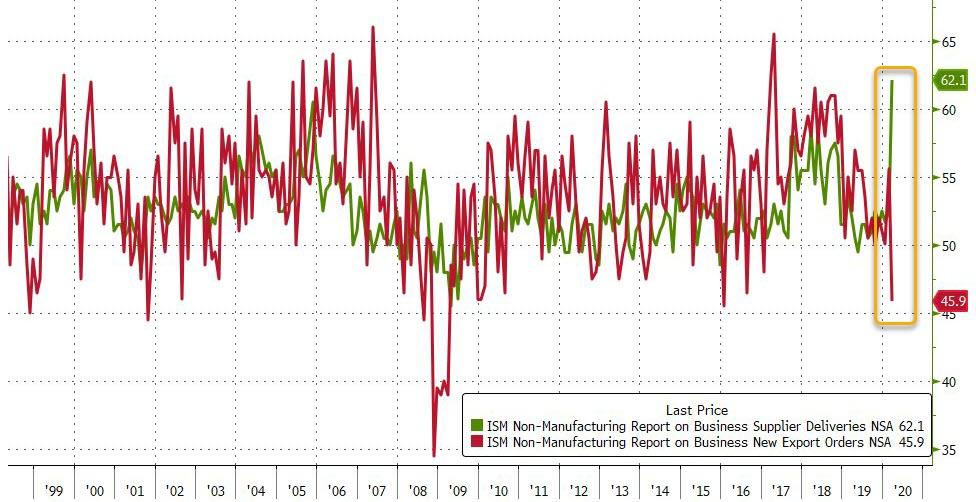

Following the drops in US Manufacturing survey data (even with ISM's data skewed by the vendor-delivery-bias issues), expectations were for further deterioration in the services side of the economy in March.

Markit's Services PMI tumbled from 49.4 to 39.8 (but was better than the expected and flash prints)

ISM's Services survey fell from 57.3 to 52.5 (the biggest decline since 2008) but dramatically better than expected

Source: Bloomberg

While March was well above the median forecast in a Bloomberg survey, the figure was propped up by considerably longer lead times. Similar to the group's manufacturing report, the supplier deliveries index for service providers surged by the most since 1997 as the Covid-19 outbreak resulted in supply-chain disruptions.

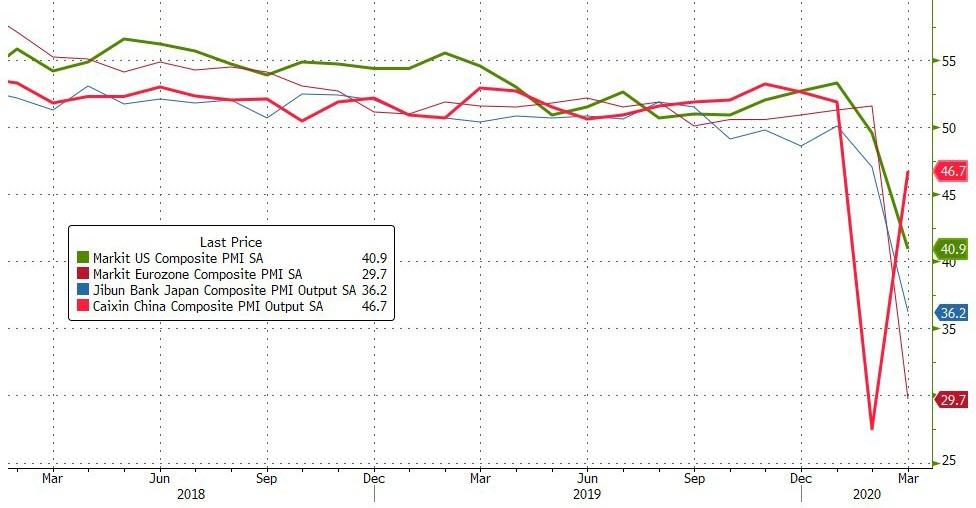

The IHS Markit Composite PMI Output Index sank to a new low of 40.9 in March, notably down from 49.6 in February.

Source: Bloomberg

The marked decrease in business activity stemmed mainly from the outbreak of COVID-19 and the impact of measures to contain the virus spread on companies and households across the country. A key driving factor behind the downturn in output was a sharp reduction in new business.

Commenting on the latest survey results, Chris Williamson, Chief Business Economist at IHS Markit, said:

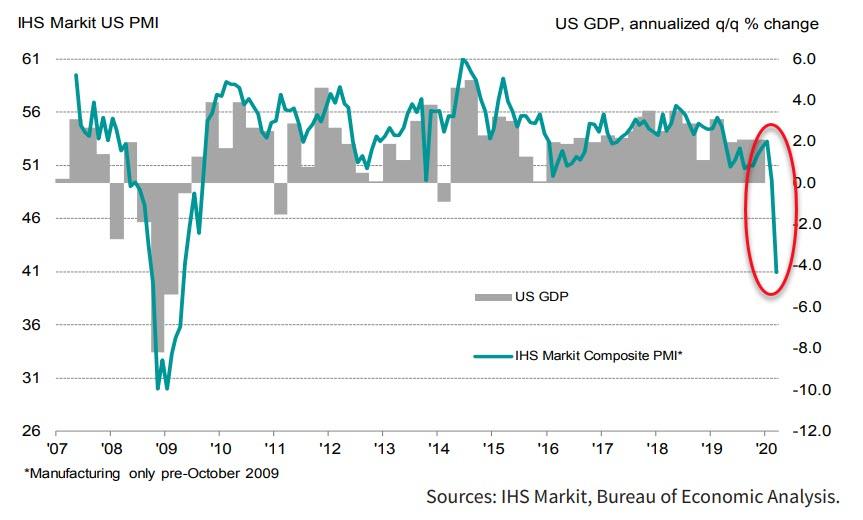

"Business activity slumped to the greatest extent for more than a decade in March as efforts to contain the spread of the COVID-19 pandemic intensified. The survey indicates that the economy contracted an annualised rate approaching 5% in March, but with more measures to fight the virus outbreak being taken this decline will likely be eclipsed by what we see in the second quarter. More nonessential businesses are being forced to close, some are going bust, and lockdowns are leading to vastly reduced consumer spending.

"Employment and prices charged for goods and services are already being slashed at rates not seen since 2009 as companies seek to aggressively cut costs and discount charges in the face of collapsing revenues.

Given that the survey does not include the self-employed, the jobless numbers are likely to rise at a much faster rate than even the slide in the PMI indicates. The policy response to the economic damage from the virus has already been unprecedented, but the collapse in business expectations for the year ahead tells us that companies are expecting far worse to come."

IHS Markit is now forecasting an around 5.5% contraction of US GDP in 2020. Not pretty!

Commenti

Posta un commento