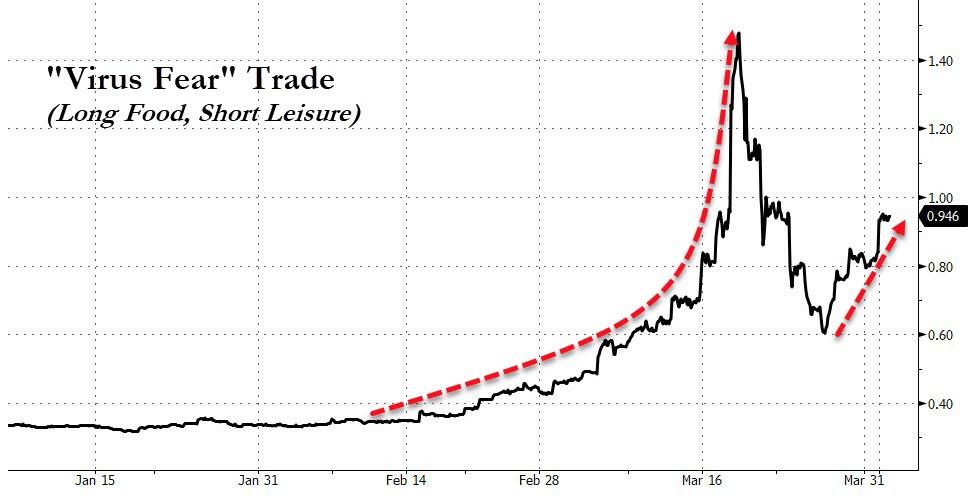

Virus-fear is back...

Source: Bloomberg

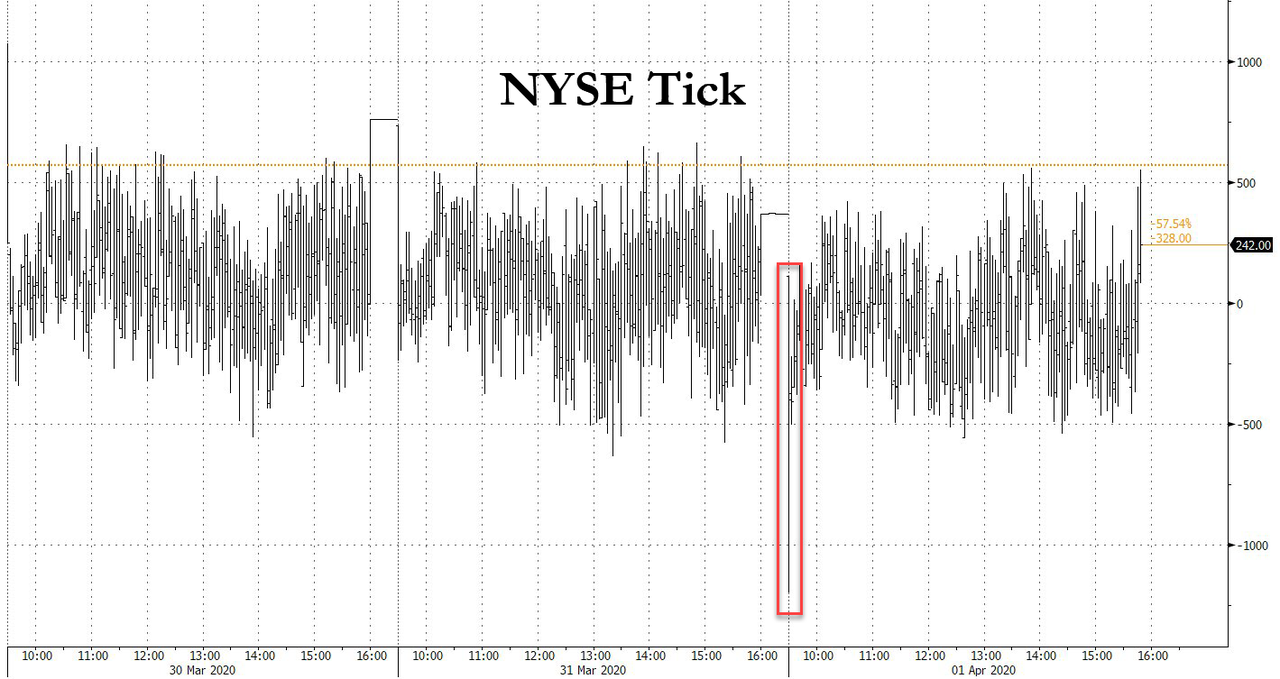

But the day started off ugly with a huge sell program...

Source: Bloomberg

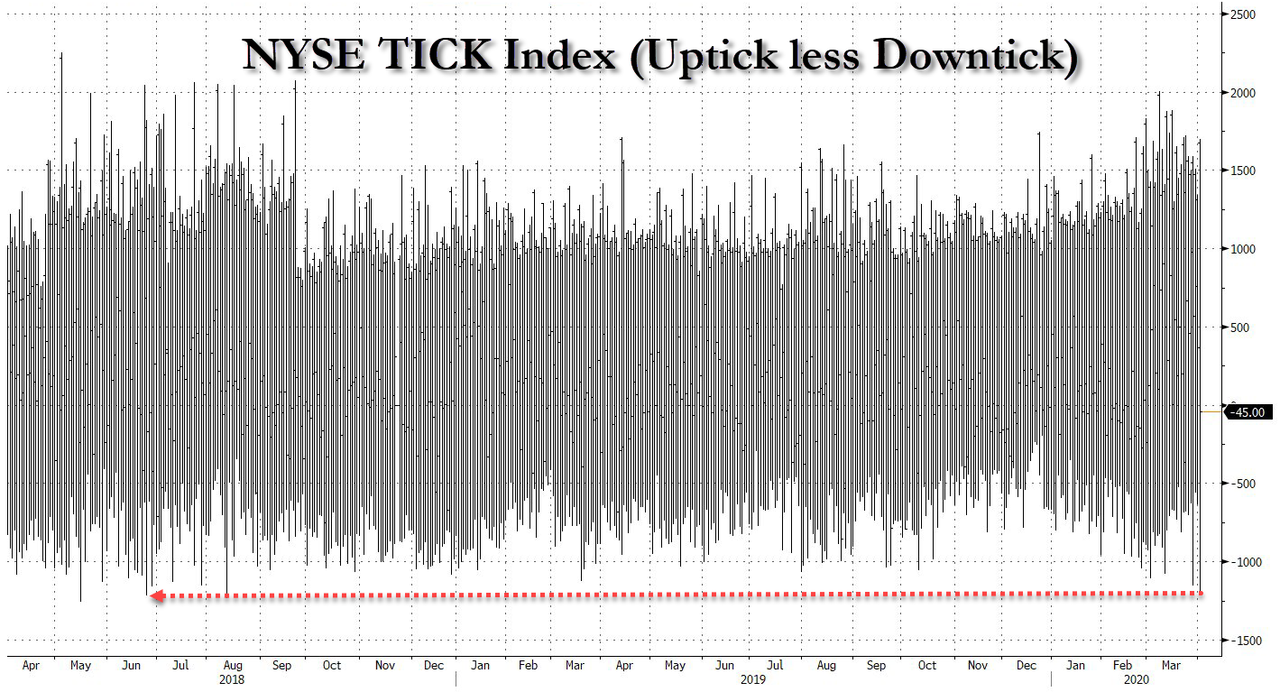

...the biggest negative TICK since Aug 13th 2018...

Source: Bloomberg

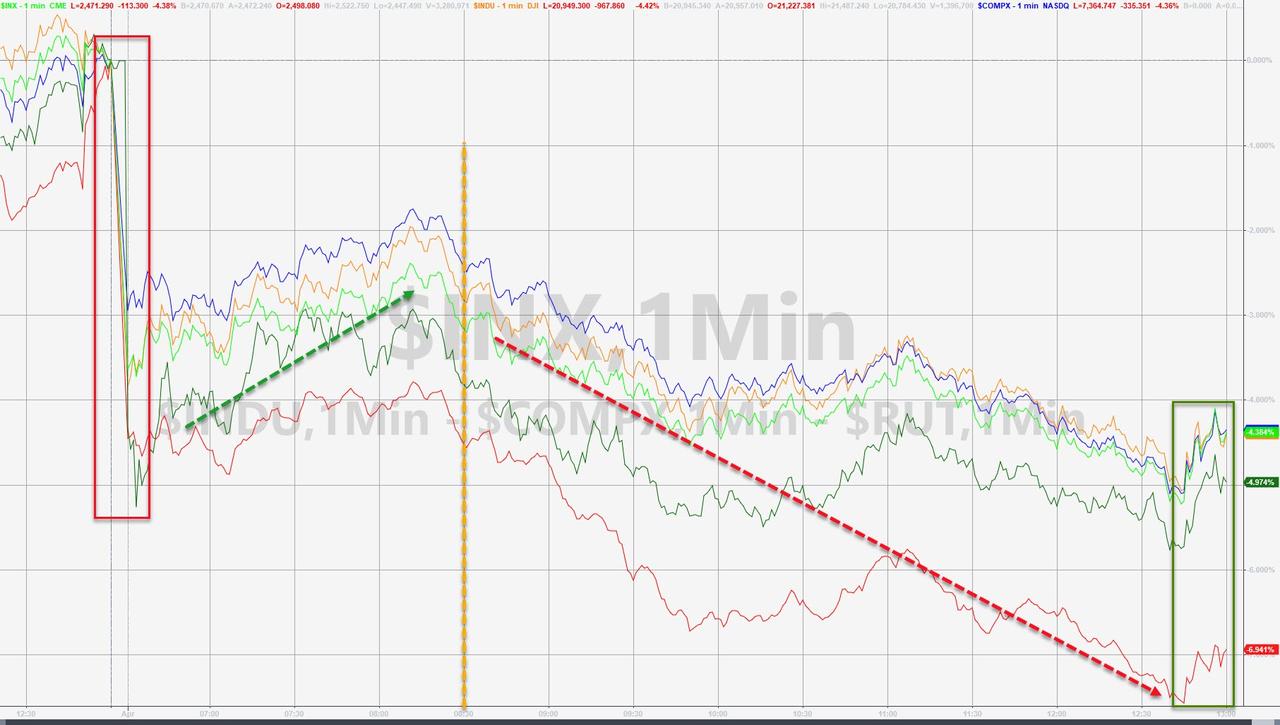

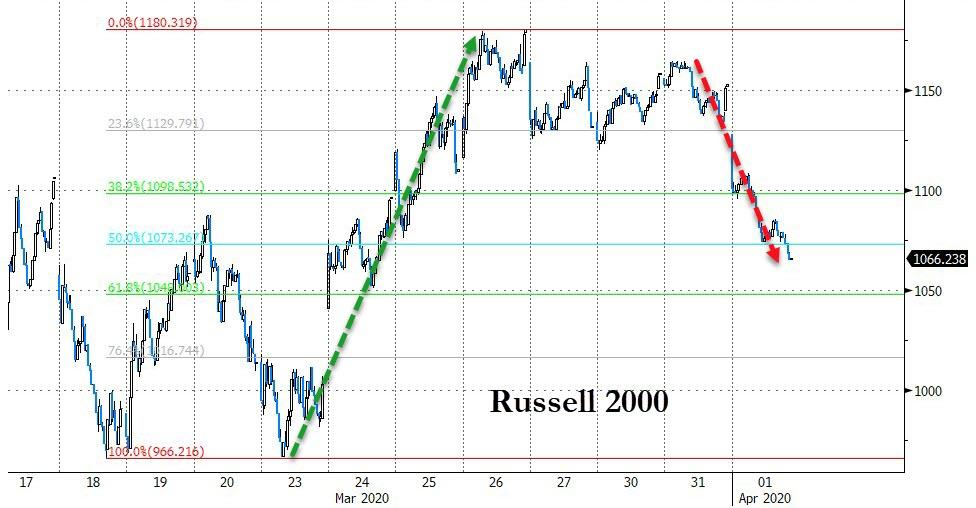

Small Caps led the bloodbathery with a near 7% collapse today (limit-down) but all the major US indices were ugly (note the weak open, bounce into EU close, then selling fir the rest of the day...

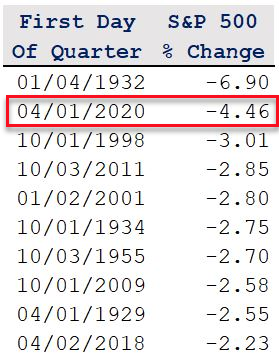

Today was the worst start to a quarter since 1932... as The Great Depression was hotting up...

Source: @Not_Jim_Cramer

The Dow lost 21k; S&P dropped below 2,500; and Russell 2000 broke back below 1,100... erasing over 50% of the dead-cat-bounce from last week...

Both Defensive and Cyclicals were equally hit today...

Source: Bloomberg

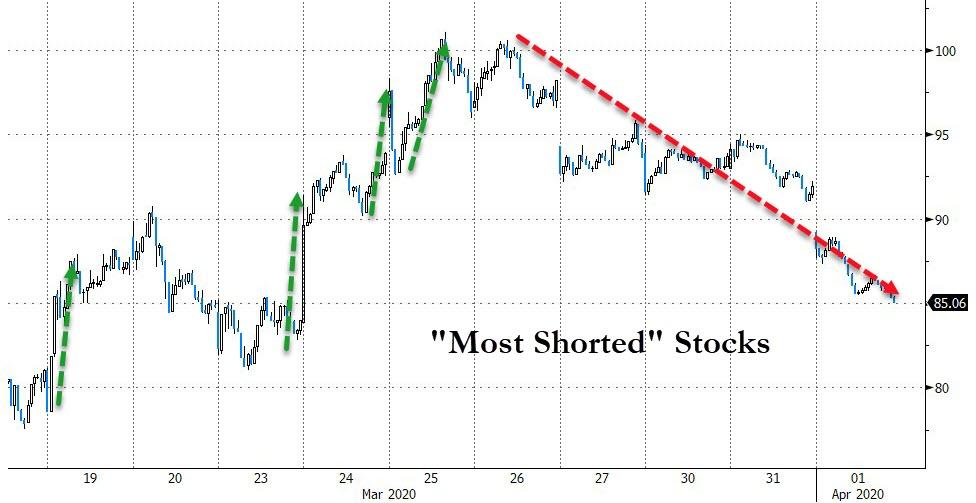

It appears the short-squeeze ammo has run out again...

Source: Bloomberg

FANG stocks were slammed, as the opening and closing bid ramps from last week have disappeared...

Source: Bloomberg

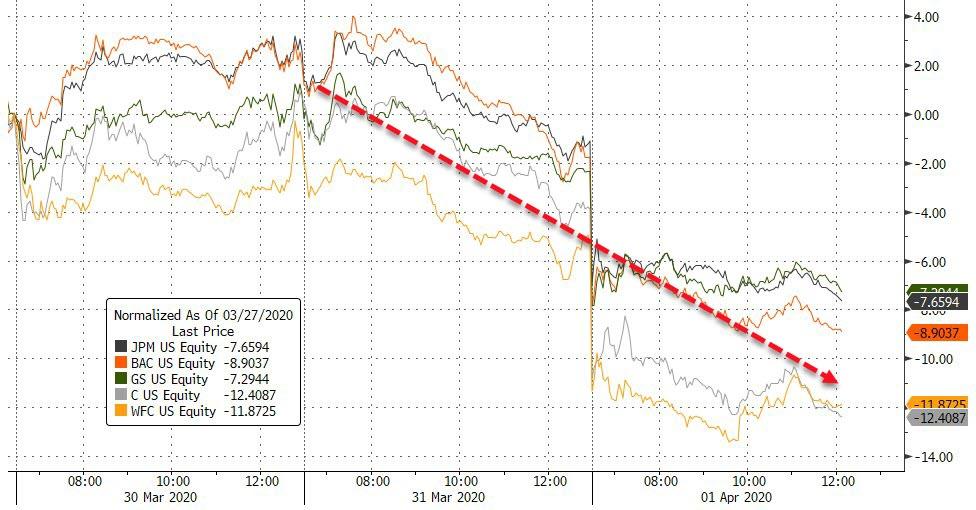

Bank stocks continued yesterday's losses...

Source: Bloomberg

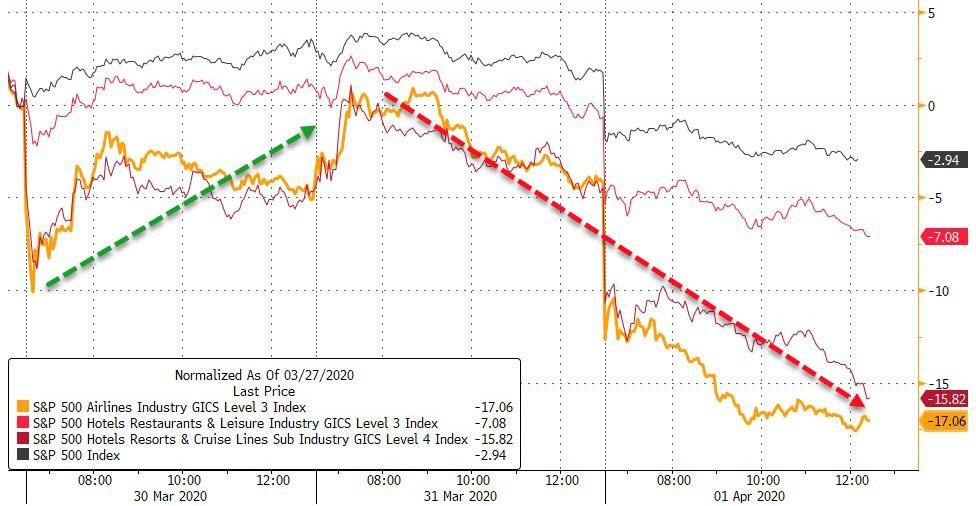

Directly-Virus-Affected sectors were monkey-hammered today with Airlines collapsing...

Source: Bloomberg

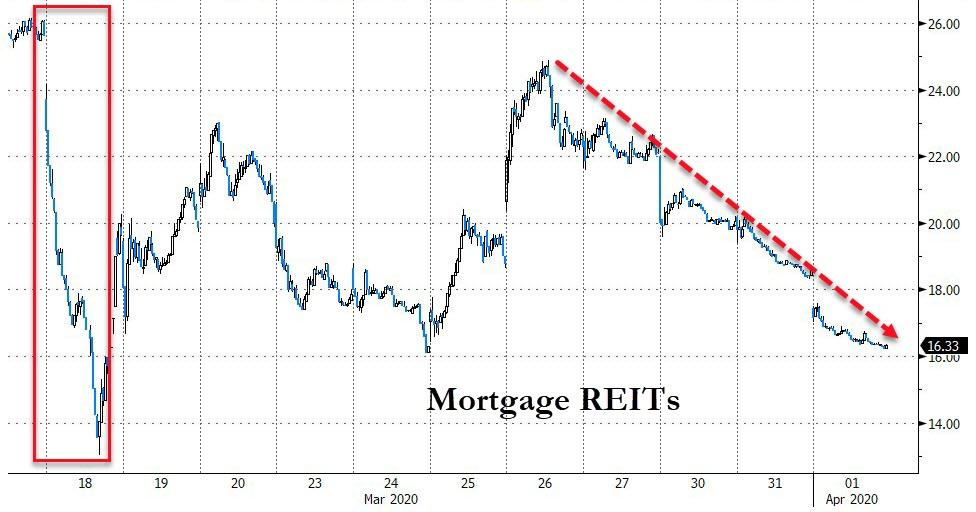

Most worrisome today was the crash in Mortgage REITs - despite weak markets and tumbling yields... systemic issues?

Source: Bloomberg

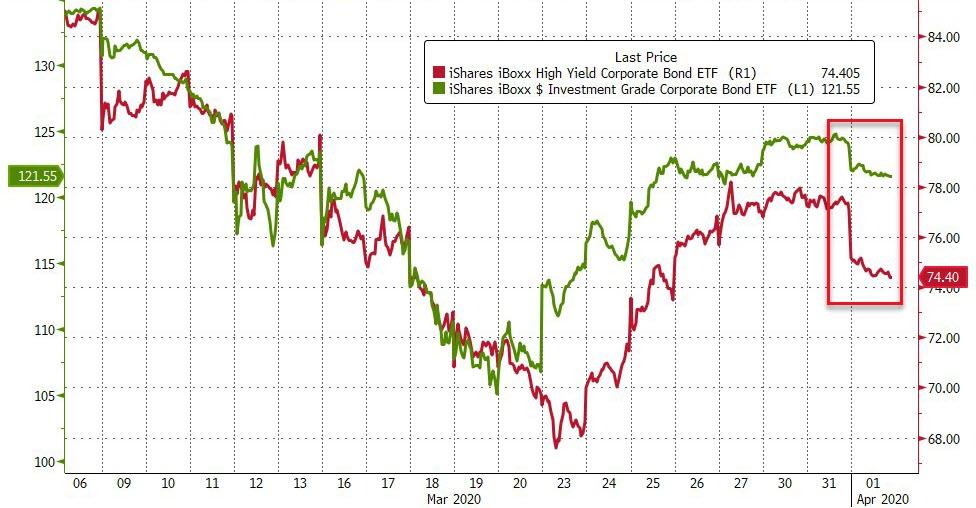

Credit was weaker today (HY worse)

Source: Bloomberg

Will stocks catch-down to bond yields now that the rebalance flows are done?

Source: Bloomberg

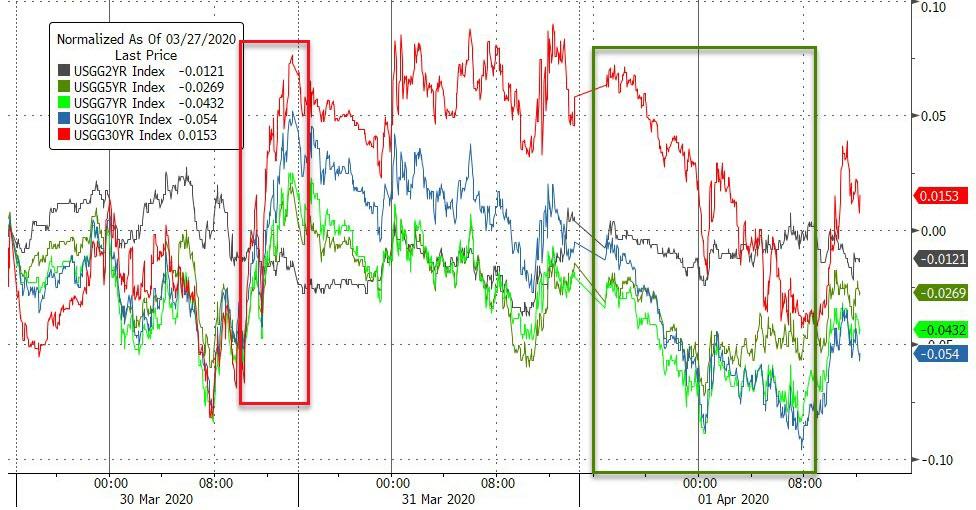

Treasury yields were all lower today as the rate-locks from record issuance lift (led by the long-end: 30Y -6bps, 2Y -1.5bps)...

Source: Bloomberg

10Y Yield tumbled back below 60bps today (57.7bps lows)...

Source: Bloomberg

The Dollar rebounded from yesterday's weakness...

Source: Bloomberg

The Dollar shortage is back, with FRA-OIS widening notably today

Source: Bloomberg

Cryptos faded today...

Source: Bloomberg

Commodities were noisy today with oil and gold up, copper down...

Source: Bloomberg

Oil prices turmoiled around today but ended higher after plunging back below $20 again

Gold futures bounced back above $1600...

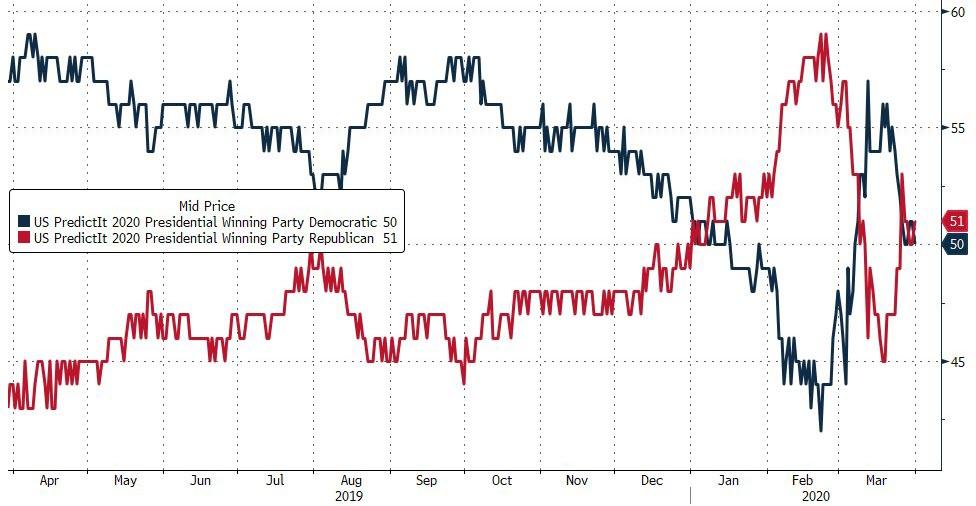

Finally, we note that Republicans have retaken the lead (albeit very marginally) in the prediction markets for the November election...

Source: Bloomberg

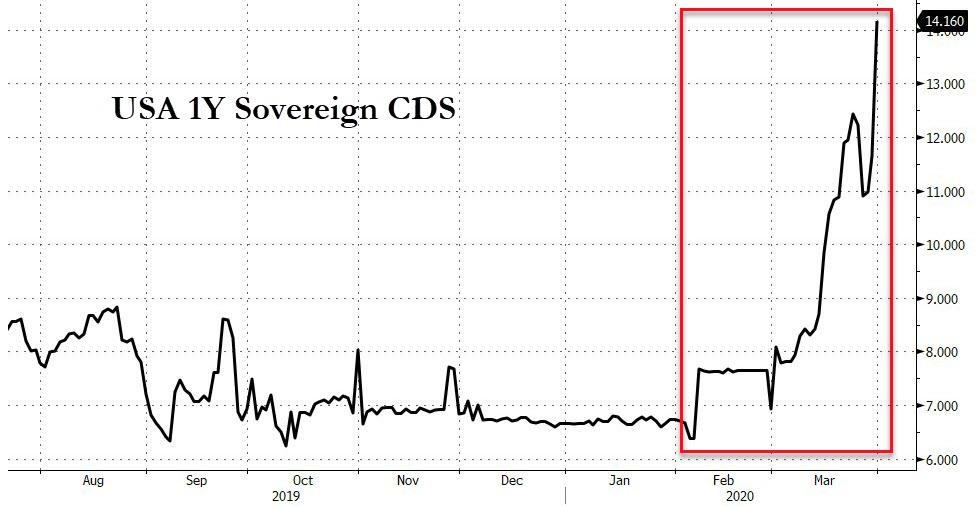

And amid all the ongoing calls for more and more rounds of fiscal stimulus and helicopter money, USA sovereign/deval risk is starting to rise rapidly...

Source: Bloomberg

Commenti

Posta un commento