Grant began by slamming Jay Powell's seemingly blinkered proclamation that "he sees no prospective consequences with regard the purchasing power of the dollar" as "very concerning" adding more pertinently that he thinks "that wilful ignorance is a clear-and-present-danger for creditors of The United States."

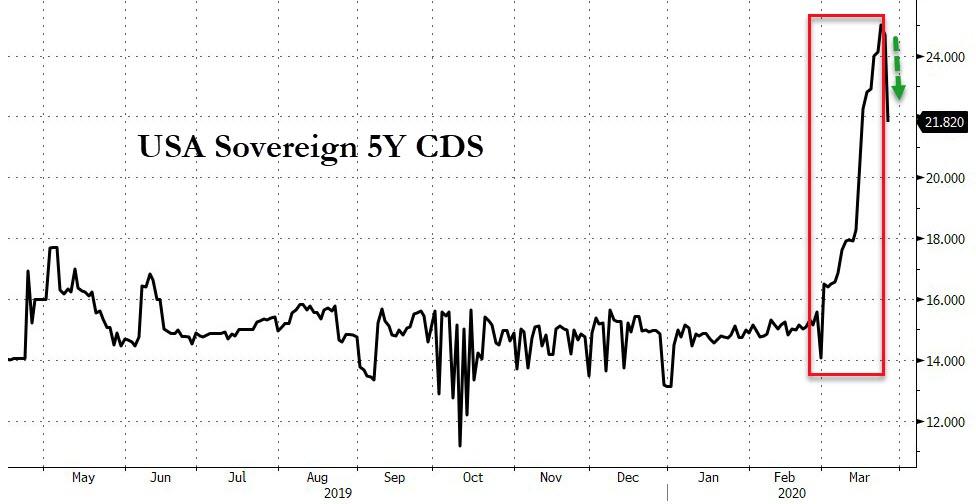

It appears his fears are starting to be warranted as USA Sovereign credit risk is rising...

"I am in favor of life going on," says Grant when asked by the anchor, "shouldn't The Fed do something amid this massive global shutdown?"

The alternative, the venerable bond guru exclaims is the direction we are heading - "shutting everything down and putting the government in charge."

Bernie Sanders may (or may not) be out of the presidential race but, as Grant highlights, "his programs are being implemented in fact daily."

"One can die of despair as well as disease," warned Grant, reminding viewers of the consequences of mass self-incarceration.

"There are health consequences to isolation, and health consequences to unemployment.. and life as it must go on is is a precious thing too and we ought to at least consider what we are condemning ourselves to if we choose to shut everything down for another month or two or three."

"I think it would be a fatal error."

Once again, the CNBC anchor urged Grant to support massive intervention but exclaiming "desperate times call for desperate measures."

His retort shut down her argument quickly:

"experts are not expert in a dis-positive way, there is no certainty about this, just as there is no certainty in finance or indeed life," and Grant adds ominously that "the cure is prospectively worse than the disease."

"The delegation of political and economic authority to the US government to suppress this crisis is a clear and present danger."

Finally, Grant, whose wife is a physician, reminded the anchors that the current actions (and consequences) have a direct analogy with the opioid crisis, as "in the early 2000s, the medical profession got it into its head that pain was the vital sign, and that no one ought to be in pain... this led to the deadly over-prescription of opioids."

By the same token, Grant analogizes, "The Fed has intervened at ever-closer intervals to suppress the symptoms of misallocation of resources and the mis-pricing of credit. These radical interventions have become ever-more drastic and the 'doctor-feel-goods' of our central banks have worked to destroy the pricing mechanism in credit.

Simply put, credit and equity markets "have become administered government-set indicators, rather than sensitive- and information-rich prices... and we are paying the price for that through the misallocation of resources."

Grant ends on a hanging chad of a rhetorical question "what do corrections correct? Is there no salutary role for recessions and bear markets?"

Of course there is, he answers, "they separate the sound from the unsound, they separate the well-financed from the over-leveraged and if we never have these episodes of economic pain, we will be much the worse for it."

Commenti

Posta un commento