Fed Panics As Foreigners Dump A Record $109 Billion In US Treasuries

Exactly one week ago, when we highlighted the unprecedented surge in Fed Treasury purchases which since March 19 has amounted to $75BN per day until tomorrow when it tapers modestly to $60BN, we said that the Fed's record ramp in debt monetization "is hardly an accident: one look at the Treasury securities held in custody at the Fed shows that the past two weeks have seen a whopping $50BN in foreign central bank sales, a 1.7% drop which was the highest in six years."

As we also noted, "the selling may have contributed to record volatility in the Treasury market and prompted the Fed's intervention. More importantly, it also means that the biggest buyer of US Treasurys in the past decade, foreign official institutions (i.e., central banks and reserve managers) are now sellers, so now the U.S. government needs private investors to soak up the ever increasing debt issuance."

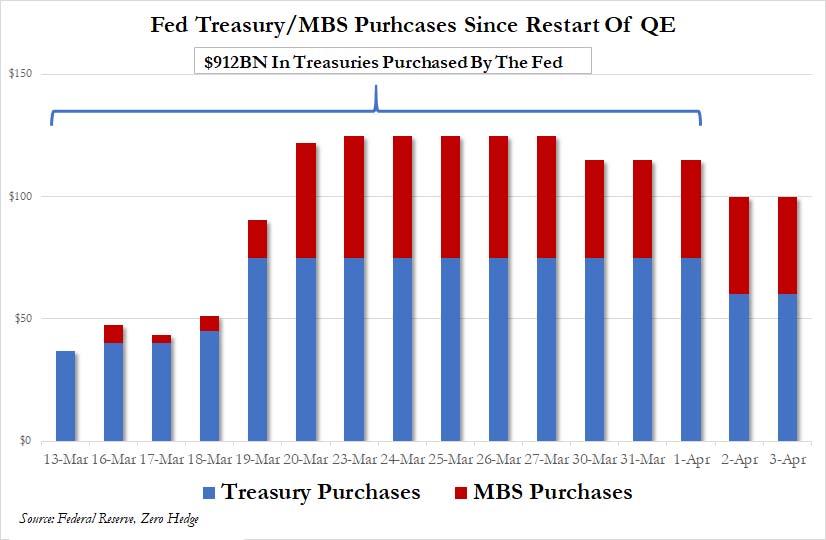

But since private investors are busy, trying to avoid getting killed by a deadly Chinese virus, it means that only the Fed now can fund the exploding US budget deficit... which is precisely what it has been doing, having purchased a record $912 billion in US Treasuries since the relaunch of official QE (hence expanded to unlimited QE) on March 13.

But here a problem emerged: because while the Fed may have been hoping to stabilize the bond market and ease the ongoing liquidation of Treasurys by foreign official accounts, it failed, and in the week ending March 25, the amount of Treasurys held in custody at the Fed on behalf of foreign accounts tumbled by a whopping $58BN, bringing the total weekly average to $2.891 trillion, the lowest since April 2017... when total US debt was nearly $4 trillion lower, or $19.8 trillion compared to $23.7 trillion today.

In total, in the turbulent month of March when global markets finally ended the longest bull market of all time, and crashed as much as 35%, and when oil lost more than 50% of its value overnight as Saudi Arabia launched an all out price war with virtually everyone else, Treasurys held in custody at the Fed on behalf of foreign central banks, sovereigns and reserve managers dropped by a record $109 billion - the biggest monthly drop in history.

Another indicator of central banks' positioning in Treasuries is primary dealer holdings, which tend to rise when official accounts are selling, according to Bloomberg. And, indeed, according to lagged Fed data, Dealer holdings of Treasuries had surged to $272 billion as of March 18, from $193 billion at the start of February, as foreigners sold their positions to Dealers.

"The fall in custody holdings is a clear signal that foreign central banks - which have a lot of Treasury holdings - have been selling them to source dollars," Subadra Rajappa, head of rates at Societe Generale told Bloomberg. "They need access to dollars as a lot of their payments are in dollars and that has driven them to sell Treasuries."

The ongoing liquidation in foreign Treasury holdings - largely the result of the continued collapse in the price of oil as oil-exporters are forced to liquidate assets to obtain much needed dollars - led to the Fed's panicked scramble to announce a foreign central bank repo facility, which it did on Tuesday morning, when it stopped short of saying it wanted to prevent a cascading domino effect from the Treasury liquidation, but made it very clear that the program will provide "an alternative temporary source of U.S. dollars other than sales of securities in the open market."

Translation: stop selling Treasurys as the world's (formerly?) most liquid market is now suddenly extremely illiquid, and ongoing sales will only further destabilize it.

Credit Suisse rate strategist Jonathan Cohn echoed Rajappa saying the new repo facility "effectively backstops foreign central banks from forced liquidation of their Treasury holdings into dysfunctional markets."

The new repo program "is a sensible second-best solution for major countries that are outside the enlarged Fed FX swaps network but have substantial corporate dollar funding needs," said former NY Fed spokesman Krishna Guha, currently head of central-bank strategy at Evercore ISI. "This group includes China, which ought to be eligible for the new program, though the Fed release is not clear on this point."

So will the Fed succeed in halting foreign Treasury sales thanks to the brand new repo facility? Or will foreign central banks skip the repo facility, just as US dealers have done for the past 2 weeks, and continue to liquidate forcing the Fed - that last resort monetizer of US deficit and debt issuance - to buy even more Treasurys each day?

We'll know the answer this time next week when the latest custody data is released, and this time it will include the fully functioning foreign repo facility.

Commenti

Posta un commento