The U.S. debt is the sum of all outstanding debt owed by the federal government. As of Dec. 29, 2019, it exceeded $23.2 trillion.1 It passed the milestone of $23 trillion in October 2019. The U.S. Treasury Department tracks the current total public debt outstanding and this figure changes daily. The debt clock in New York also tracks it.

Japan Debt Clock: What Is A Rolling Liquidity Strategy Doing To Economic Health? ¥ 1,072,820,320,692,290 Convert to USD Source: Japanese Government Data. Excluding fiscal investment and loan program bonds and FBs from outstanding government bonds.

Read more at: https://commodity.com/debt-clock/japan/

Read more at: https://commodity.com/debt-clock/japan/

Japanese Company Bankruptcies Rise for First Time Since 2008

Economy Mar 2, 2020

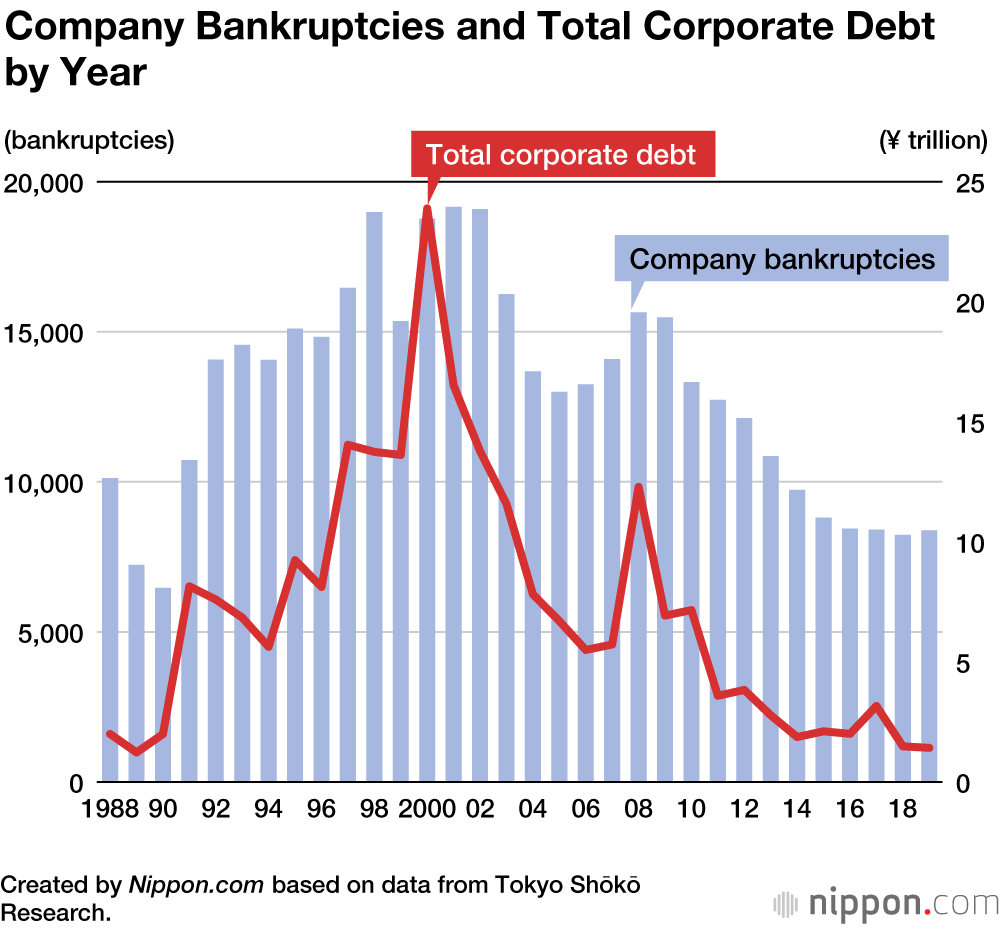

In 2019, the number of Japanese companies with net liabilities in excess of ¥10 million rose 1.7% to 8,383, the highest level since the 2008 financial crisis, according to a report by credit reporting agency Tokyo Shōkō Research.

At the same time, total corporate debt fell by 4.1% to ¥1.4 trillion, which was a mere 5.9% of the ¥23.9 trillion recorded in 2000, the most indebted year on record, and 11.5% of the ¥12.3 trillion seen in 2008. The number of businesses that went bankrupt with debts of ¥1 billion or more during the period was only 185, which represents the lowest level in 30 years, and makes 2019 the second year in a row in which this figure has been below 200.

Three of the ten industries monitored experienced fewer bankruptcies in 2019 than in the year before. However, the service industry, which is said to have been impacted by the October increase in consumption tax, saw 2,569 bankruptcies, up 2.2%, and the retail industry saw 1,230 bankruptcies, which is an increase of 8.6%. Bankruptcies in the haulage industry, which is currently facing skyrocketing payroll costs as a result of the national truck driver shortage, were up 6.7% to 254, the highest level in seven years.

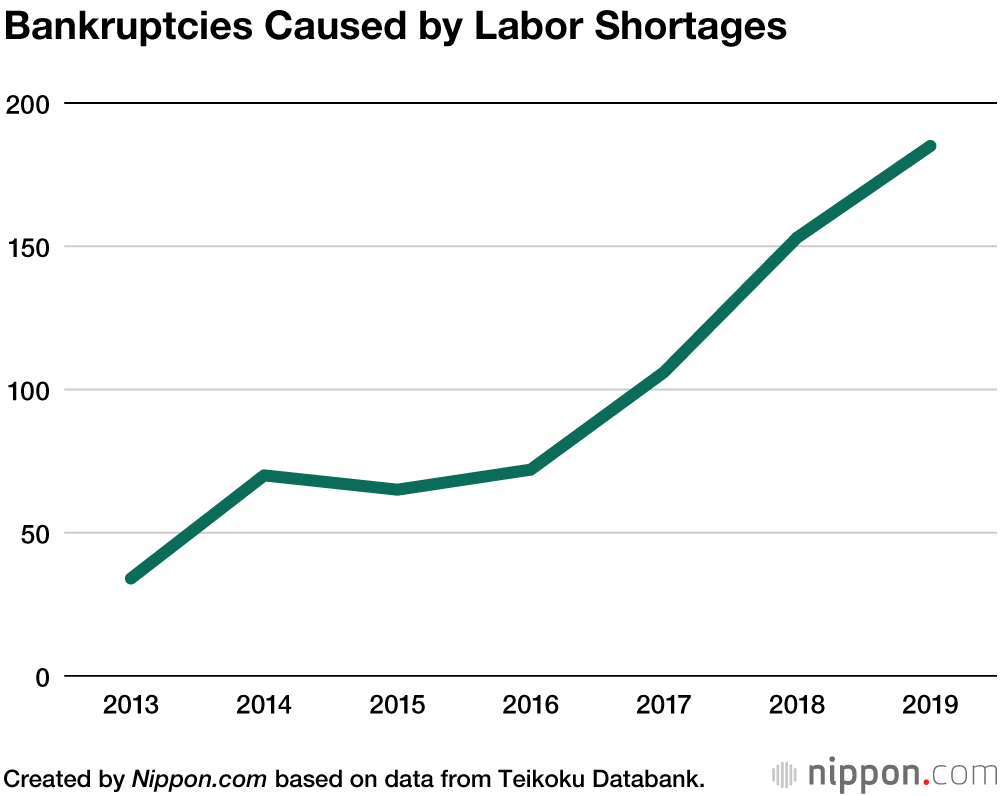

According to Teikoku Databank, in 2019, a total of 185 companies went bankrupt due to labor shortages. This represents a 20.9% year-on-year increase, and makes 2019 the fourth consecutive year in which this number has increased. Over half of the cases involved companies in the service industry (54) or the construction industry (49). Companies driven to bankruptcy by labor shortages recorded combined liabilities of ¥32.7 billion, an increase of 46.1% on the preceding year.

Cumulative figures for bankruptcies caused by labor shortages for the seven years since records began show that road freight transport has had most cases with 74 bankruptcies. The increasing difficulty in hiring truck drivers is thought to have made it more difficult for haulage companies to win orders, causing cash flow problems. Road freight transport was followed by the timber construction industry (43), the elderly care and welfare industry (37), and the software development contracting industry (29).

(Translated from Japanese. Banner photograph: Ushiko/PIXTA)

Non-financial corporations - statistics on financial assets and liabilities

Data extracted in December 2019.

Planned article update: December 2020.

In 2018, EU total financial assets and liabilities of non-financial corporations (including equity and investment fund shares) were valued at EUR 32 531 billion and EUR 48 402 billion respectively.

EU corporate debt increased from 91.0 % of GDP in 2008 to 96.5 % in 2018, while EU-28 corporate financial leverage (the debt/equity ratio) fell from 82.2 % to 58.8 % during the same period.

(billion EUR)

Source: Eurostat (nasa_10_f_bs)

This article focuses on the annual stock of financial assets and liabilities for non-financial corporations in the European Union (EU) and the euro area; note there is a complementary article that provides similar information for financial assets and liabilities of households.

The non-financial corporations sector comprises all private and public corporate enterprises that produce goods or provide non-financial services to the market. Across the EU-28, the financial assets of non-financial corporations mainly comprise equity and investment fund shares, loans, other accounts receivable, and currency and deposits. The financial liabilities of non-financial corporations mainly comprise equity and investment fund shares, loans and other accounts payable.

The data presented in this article relate to a detailed set of non-consolidated financial balance sheets for the non-financial corporations sector released by Eurostat. Note that statistics detailing the financial account may be consolidated or non-consolidated; the latter record not only transactions between sectors but also transactions within the same sector.

The article provides an analysis of financial assets and liabilities of non-financial corporations across the EU-28 and the euro area (EA-19), as well as for individual EU Member States, three EFTA countries and Turkey for the latest year available (2018) and for developments over the previous 10 years. Some indicators are presented in relation to gross domestic product (GDP), which is beneficial for making cross-country comparisons, especially between countries of different size.

Value of assets and liabilities in the EU

The value of financial liabilities for non-financial corporations was much greater than the value of their financial assets

Total financial assets of non-financial corporations in the EU-28 were valued at EUR 32 531 billion in 2018 (see Figure 1); this was much lower than the value of their financial liabilities, which stood at EUR 48 402 billion.

In 2008, total financial assets of EU-28 non-financial corporations represented 60.5 % of total financial liabilities. However, this ratio rose in successive years during the last 10 years, such that total financial assets represented 67.2 % of total financial liabilities by 2018.

In the years prior to the onset of the global financial and economic crisis, there was a marked rise in the debt levels (indebtedness) of non-financial corporations. However, the total value of financial assets and liabilities of non-financial corporations in the EU-28 and the euro area fell considerably in 2008. Thereafter, the value of both assets and liabilities rebounded in 2009 and 2010, remained relatively unchanged in 2011, and then followed an upward development throughout the period 2012 to 2017; a fall in financial liabilities was reported for the EU-28 and the euro area in 2018 while there was little change in financial assets.

When compared with the situation prior to the global financial and economic crisis (in other words, data for 2007), the value of the financial assets for EU-28 non-financial corporations had returned to their pre-crisis levels by 2010, while it took an additional two years before the value of total financial liabilities did so. These developments in the wake of the crisis may reflect, at least to some degree, a reassessment of asset valuations, balance sheet adjustments and a reduction in corporate debt.

Corporate debt, defined as debt securities and loans as a percentage of GDP, is an important measure of the financial solvency of non-financial corporations. Between 2008 and 2018 corporate debt increased from 91.0 % to 96.5 % of GDP. The debt to equity ratio, defined as debt securities and loans divided by equity and investment fund shares, is an important measure of financial leverage. Between 2008 and 2018 this ratio fell from 82.2 % to 58.8 %.

(billion EUR)

Source: Eurostat (nasa_10_f_bs)

Assets and liabilities relative to GDP in the EU

Financial liabilities of EU-28 non-financial corporations valued just over three times as high as GDP

The ratio of financial assets and liabilities relative to GDP is shown in Figure 2. The financial assets and liabilities of non-financial corporations in the EU-28 represented, on average, 180.6 % and 286.7 % of GDP during the period covering 2008-2018.

The ratio for total financial assets of EU-28 non-financial corporations fell to a low of 147.1 % (relative to GDP) in 2008 (during the global financial and economic crisis), while the ratio for financial liabilities fell to 243.3 % the same year. The impact of the global financial and economic crisis was relatively short-lived for financial assets, as their value in relation to GDP immediately rebounded in 2009 to a similar (but slightly higher) level as that recorded before the crisis, whereas it was not until 2013 that the ratio of financial liabilities relative to GDP returned to and passed its pre-crisis level.

In 2018, the financial assets of EU-28 non-financial corporations were valued at 204.6 % (relative to GDP), while financial liabilities were valued at 304.4 %; both of these values were lower than the corresponding ratios recorded in 2017.

(%, relative to GDP)

Source: Eurostat (nasa_10_f_bs)

Structure of assets and liabilities in the EU

Equity and investment fund shares: the most prominent form of asset and liability

Equity and investment fund shares, loans, other accounts receivable, and currency and deposits together made up 97.7 % of the total financial assets of EU-28 non-financial corporations in 2018 (see Figure 3). Equity and investment fund shares accounted for the highest share, around half of the total (49.6 %). Within this instrument category, equity accounted for around 97 % of the total.

(% share of total financial assets of non-financial corporations)

Source: Eurostat (nasa_10_f_bs)

In 2018, equity and investment fund shares, loans, other accounts payable, and debt securities together made up 97.2 % of the total financial liabilities of EU-28 non-financial corporations (see Figure 4). The share of equity and investment fund shares in total financial liabilities was even higher than for assets, reaching 53.9 % with equity liabilities accounting for all of this instrument category.

(% share of total financial liabilities of non-financial corporations)

Source: Eurostat (nasa_10_f_bs)

Developments in the EU

The information presented in Figures 5 and 6 is in the form of indices, each series starting with a value of 100 in 2008. It is important to bear in mind the relative weight of each financial instrument in total financial assets and liabilities (as shown in Figures 3 and 4) when considering their developments over time.

During the period 2008-2018, there was steady and almost uninterrupted growth in the value of loans that were held as financial assets by EU-28 non-financial corporations (see Figure 5); a similar pattern with slightly higher growth rates was observed for currency and deposits. By contrast, there was a more mixed development for equity and investment fund shares, as their asset value rose sharply between 2008 and 2010, fell slightly in 2011, then continued their relatively steep upward progression through to 2017, before falling in 2018. The value of financial assets held by EU-28 non-financial corporations in the form of insurance, pensions and standardised guarantees was almost unchanged between 2008 and 2018.

It should be noted that the values of equity and investment fund shares, debt securities and financial derivatives are affected by changes in prices of these instruments in financial markets.

(index, 2008 = 100)

Source: Eurostat (nasa_10_f_bs)

Figure 6 shows similar information for the development of various financial liabilities held by EU-28 non-financial corporations. Aside from financial derivatives and employee stock options, the value of liabilities for each financial instrument was higher in 2018 than in 2008, with some relatively large fluctuations from one year to the next during the period under consideration. This was particularly true for insurance, pensions and standardised guarantees and financial derivatives and employee stock options (note however, that these accounted for just 2.4 % and 0.3 % of total financial liabilities respectively in 2018).

In a similar development to that for assets, the value of liabilities for equity and investment fund shares recovered rapidly after 2008 and followed a generally upward path (apart from falls in 2011 and 2018). By contrast, there was a relatively slow upward development for the second most used instrument, loans, as the value of liabilities rose by 1.3-6.2 % per annum during the period 2008-2018, aside from modest reductions in 2009 (-0.7 %) and 2013 (-1.1 %).

(index, 2008 = 100)

Source: Eurostat (nasa_10_f_bs)

France held more than one quarter of the EU-28's financial assets and almost one quarter of its liabilities

Figure 7 shows the share of each EU Member State in the total financial assets and liabilities of non-financial corporations in the EU-28; note that the figure is split into two parts with different scales on the y-axes.

In 2018, non-financial corporations in France held the highest share (29.3 %) of total financial assets held by non-financial corporations in the EU-28, followed by those from Germany (14.1 %), the United Kingdom (8.4 %), the Netherlands (8.3 %) and Spain (7.7 %). French non-financial corporations also had the highest share (24.4 %) of EU-28 financial liabilities, followed by non-financial corporations from the United Kingdom (12.6 %), Germany (12.5 %), Spain (8.1 %), Italy (7.8 %) and the Netherlands (7.2 %). The high share of France in EU-28 financial assets and liabilities relative to Germany is associated with a relatively high share of inter-company asset positions. Excluding these positions, the data for Germany and France are broadly similar.

A comparison between the shares of financial assets and financial liabilities for each EU Member State reveals that these were generally quite similar. However, non-financial corporations in France held a considerably higher share of the EU-28's total financial assets than their share of EU-28 total financial liabilities (a difference of 4.9 percentage points), while the opposite was true in the United Kingdom, as its share of EU-28 financial liabilities was 4.2 points higher than its share of financial assets; Italy also had a notably higher share of financial liabilities, with a difference of 2.1 points when compared with its share of financial assets.

It is interesting to note that some of the relatively small EU Member States accounted for quite high shares of EU-28 financial assets and liabilities. This was particularly true for non-financial corporations in Ireland and Luxembourg, which may reflect, at least in part, the activities of multinational corporations and the impact of foreign direct investment (FDI); note that the majority of the indigenous non-financial corporations in these economies are relatively small and are largely reliant on domestic credit institutions, while multinationals tend to have much greater access to a broader range of international sources of finance.

(% of EU-28 total)

Source: Eurostat (nasa_10_f_bs)

Developments in the EU Member States

Average annual rates of change for total financial assets and liabilities of non-financial corporations are shown in Figure 8. Across the whole of the EU-28 financial assets rose, on average, by 5.4 % per year during the period 2008-2018, while the growth rate for financial liabilities was somewhat lower at 4.3 % per year.

Among the EU Member States, the highest average annual growth rates for the period 2008-2018 were recorded in Ireland and Malta, with the value of financial assets held by non-financial corporations rising on average by 15.2 % and 11.7 % per year, while the value of financial liabilities rose by an average of 14.0 % and 8.7 % per year. A majority (21) of Member States saw the value of their non-financial corporations' financial assets and liabilities rise on average by 1.0-8.0 % per year, although there were several Member States where growth was more subdued or where the values of assets and liabilities were actually lower in 2018 than in 2008. Greece and Slovenia recorded lower values both for assets and for liabilities, while the speed at which financial liabilities of non-financial corporations grew was relatively subdued (0.4-0.8 % per year) in Italy, Romania and Spain.

(%)

Source: Eurostat (nasa_10_f_bs)

The value of financial assets for Irish non-financial corporations relative to GDP was 2.4 times as high in 2018 as it had been in 2008

Figure 9 shows the change in the value of financial assets and liabilities relative to GDP between 2008 and 2018. In keeping with the overall figures for the EU-28 it was commonplace to find that these ratios generally rose during the period under consideration.

In Ireland, the value of total financial assets of non-financial corporations relative to GDP was 2.4 times as high in 2018 as it had been in 2008, while the next highest rates of change were recorded in France and the Netherlands (another economy where multinational corporations play a relatively important role). Despite a reduction in their value of financial assets relative to GDP, non-financial corporations in Luxembourg continued to record the highest ratio among the EU Member States (745 % in 2018). Aside from Luxembourg, there were five other EU Member States where a decline was reported between 2008 and 2018: Bulgaria, the United Kingdom, Slovenia, Greece and Romania.

The value of total financial liabilities of non-financial corporations relative to GDP also rose at a rapid pace in Ireland: the value of liabilities was 2.2 times as high in 2018 as in 2008. The ratio of the value of financial liabilities to GDP peaked in Luxembourg at 822 % in 2018, followed by Ireland (707 %) and Sweden (533 %). There were nine EU Member States where a decline was reported when comparing the value of financial liabilities relative to GDP between 2008 and 2018: Portugal, Spain, Italy, Czechia, Luxembourg, Bulgaria, Lithuania, Slovenia and Romania.

(%, relative to GDP)

Source: Eurostat (nasa_10_f_bs)

Structure of assets and liabilities in the EU Member States

The final two figures in this article present information relating to an analysis of financial assets (Figure 10) and financial liabilities (Figure 11) by financial instrument.

As already shown, across the EU-28 equity and investment fund shares were the principal instrument held by non-financial corporations for both assets and liabilities. This pattern was repeated in a majority of the EU Member States in 2018, with equity and investment fund shares accounting for at least half of the total value of the financial assets held by non-financial corporations in Luxembourg, the Netherlands, Spain, Sweden and France. In the Member States where equity and investment fund shares did not record the highest share of total financial assets, it was common to find that the principal instrument was other accounts receivable/payable, the only exception being Greece (where more than half of all financial assets were held as currency/deposits).

(% share of total financial assets of non-financial corporations)

Source: Eurostat (nasa_10_f_bs)

In 2018, equity and investment fund shares accounted for the highest share of total financial liabilities of non-financial corporations in all but two of the EU Member States. Their share of total financial liabilities rose above 50.0 % in 14 Member States, with shares of more than 60.0 % in France and Sweden (where the highest share was recorded, 63.3 %). In Malta, loans were the principal instrument held by non-financial corporations and their share of total financial liabilities was 41.1 %. Romania was an exception insofar as it was the only Member State to report that other accounts receivable/payable were the principal liability of non-financial corporations (47.3 % of total financial liabilities in 2018).

(% share of total financial liabilities of non-financial corporations)

Source: Eurostat (nasa_10_f_bs)

About two-thirds is debt held by the public.2 The government owes this to buyers of U.S. Treasury bills, notes, and bonds, including individuals, companies, and foreign governments.

The remaining third is intragovernmental debt. The Treasury owes this debt to its various departments who hold government account securities, such as Social Security, which is one of the biggest owners. These government account securities have been running surpluses for years and the federal government uses these surpluses to pay for other departments. These securities will come due as baby boomers retire over the next two decades. Since Social Security and trust funds are the largest owners, the answer as to who owns the U.S. debt is basically everyone's retirement money.

America's debt is the largest sovereign debt in the world for a single country. It runs neck and neck with that of the European Union, which is a unified trade body of 27 member countries.34

The national debt is greater than what America produces in a whole year. This high debt-to-gross domestic product ratio tells investors that the country might have problems repaying the loans. That's a new and worrying occurrence for the U.S. In 1988, the debt was only half of America's economic output.

Commenti

Posta un commento