Arguably the two most significant macroeconomic events taking place in markets currently are the drop in US Treasury yields to near historic lows and the breakdown of Chinese yuan below the "line in the sand" 7.0 level.

Oddly enough, a similar thing happened back in the 2015-2016 period. Readers probably remember the manufacturing/earnings recession that took place then. Even after the stock market had bottomed in February of 2016, 10-year rates continued to chug lower into July of that year and the CNY didn't bottom out until December. One could extrapolate the results from that 2015-2016 period and think that the current drop in rates and the CNY is bullish for risk assets.

That would be a mistake in our view.

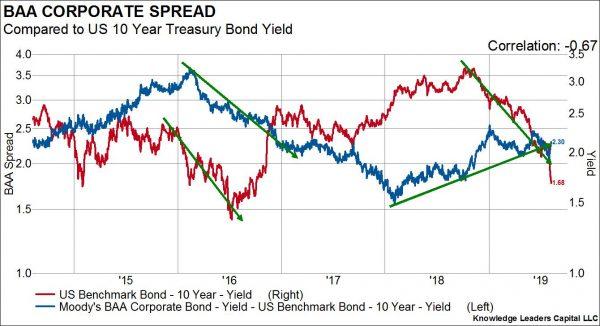

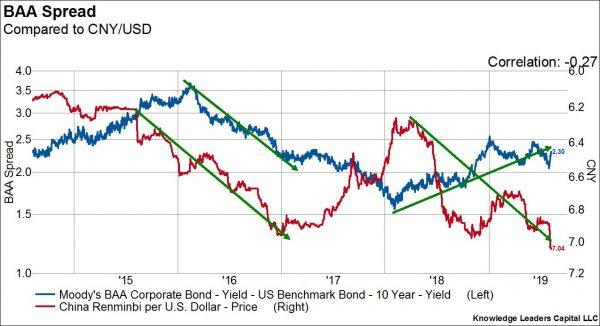

Indeed, one key difference between now and then was that growth was accelerating out of that 2015-2016 slump, and it was crystal clear by mid-year 2016 that economies had bottomed. In sympathy with that improving growth outlook, corporate BAA bond spreads (blue line, left axis in charts below) were narrowing considerably, meaning that default risk was compressing and liquidity was ample.

Fast forward to this episode of falling rates and CNY and we find growth is deteriorating and is set to keep deteriorating through year-end (as we wrote recently about here). At the same time BAA spreads are widening out, indicating all is not well within the credit markets.

Commenti

Posta un commento