"The country was in peril; he was jeopardizing his traditional rights of freedom and independence by daring to exercise them."

You can make an educated guess on just how badly the current Bond Bonanza is going to end by the number of fund managers and individuals bragging about how much they've made in Fixed Income in recent days. Tumbling Global bond yields scream global slowdown, ($15 trillion of negative yielding debt) while stocks remain resolutely optimistic. Make sense of that if you will. Remember Blain's Mantra No 1: "The Market has but one objective – to inflict the maximum amount of pain on the maximum number of participants!" And Mantra No 2: "In Bonds there is truth."

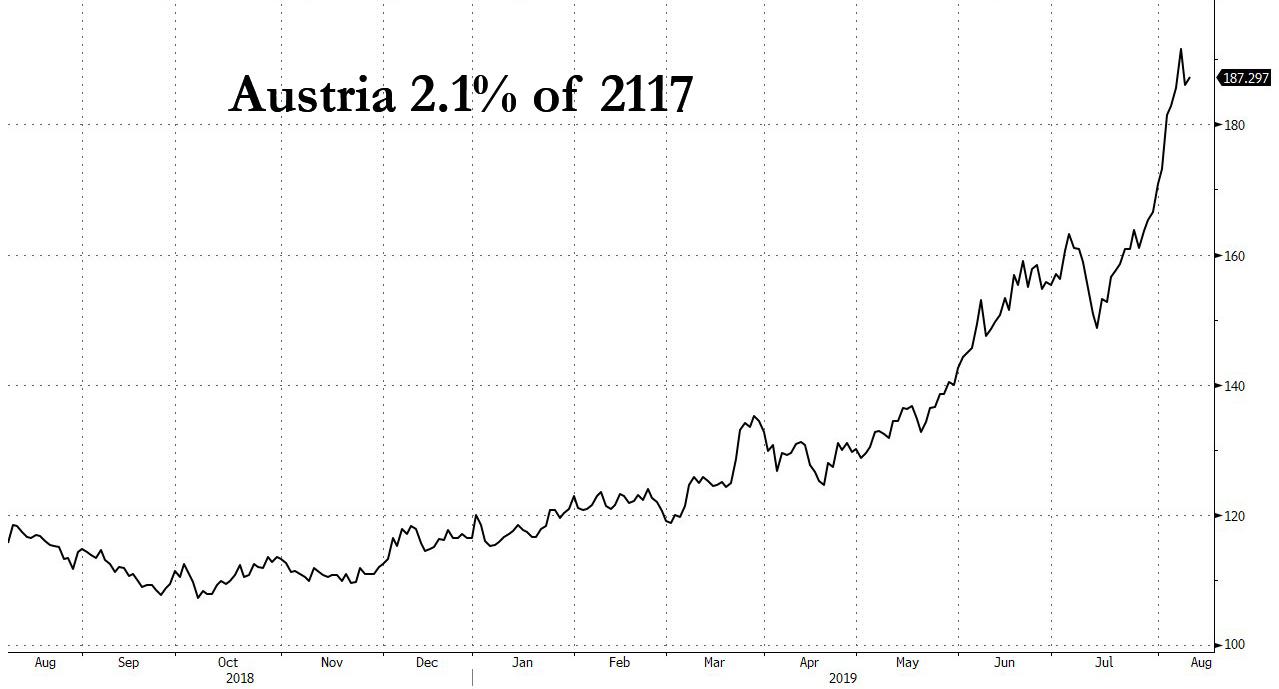

You know its past hat-stand o'clock when one of the best performing global assets is a 100yr Century bond issued by Mexico! If you'd bought the much derided 100yr Austria bond-tap a few months ago, you are up 25%! Current bond prices are so high (and the yields so low) because they reflect the likelihood today's financial fears turning into real destabilising events. In contrast, stocks are so high because they factor the expectations things will get better, central banks will keep juicing markets through easing and new QE, and the reality that stock dividend yields beat bond yields!

It's incredible investors in ultra-long bonds are crowing about such short-term returns! But that's the world – short-term is everything, while we neglect the long-term.

And the really annoying thing is – you could rationally have predicted this would happen. As the world wallowed into trade crisis, rising geopolitical tensions and expectations of slow down, it was kind of obvious central banks lacked any other policy response but to keep cutting rates and promise more financial distortion. If you'd just listened to that financial genius Donald Trump (US Readers – Sarcasm Alert) you'd have made off like the butcher's dog with the sausages!

The next question is: for how much longer does this go on?

The bottom line is lower for longer rate and QE infinity are not economically healthy. But, perhaps we are finally approaching the end of the last 12 years of economic insanity…. It's Friday, and it's been a while since I've had a good rant. Indulge me for a few moments…One of the great military quotes is Marshal of France Ferdinand Foch: "My Centre is giving way, my right is in retreat, situation excellent. I attack!"

The markets are convinced the global economy is headed towards slowdown/recession, stocks and bonds look utterly mis-priced and bubblicious, while looming trade wars, Brexit, Italy and other geopolitical minefields aplenty threaten growth. What's possibly to like about the market outlook?

Absolutely Everything! Short-term BEAR, but long-term BULL!

For a start, the picture isn't half-as-bad as it seems. In the UK and US, strip away the political noise of Trump and Brexit, and you actually got two high employment, strong pro-business, and energetic economies. Europe has far more serious issues. Trade wars and Brexit won't help, but we've got through far worse times.

My spidey senses tell me the US and UK are moving into a new phase – which will redefine markets. Let me try to explain: I'd characterise the last 12 years as a series of monetary and policy mistakes. Now we might be approaching the converse – a new era of Fiscal Stimulus. In the past the mere whiff of governments plotting fiscal spending to reflate jaded economies would send markets a flutter, bond yield soaring and currencies crashing. Markets don't like high-spending governments, because governments don't spend money well.

Now we face a completely unconventional and very different markets. When interest rates are this low and have done precisely f**k-all to stimulate the Occidental economy, then it's time to do something different, and do it well. We have to do something different - does anyone really think the Fed or the ECB is going to stave off looming recession with a further 25 bp of interest rates cuts? Sure, they will try… but experience shows its pretty pointless. Time for something different.

Done well, Fiscal Stimulus might be a good thing. (And let's try not get sucked into arguments about Neo-Keynsian New Monetary Theory, which pretty much sounds like fiscal carpet bombing. Please don't anyone suggest it to Labour MPs – they will be all over it like the proverbial cheap suit.)

Fiscal policy has a bad rep.

Its extraordinary how much the focus and concerns of financial markets have shifted over the last 12 years. In 2008 it was the "End of the World" as Lehman went down, and the Fed started monetary experimentation on the grand scale through quantitative easing. In 2009 governments were ruing the costs of bank bailouts, while the market wondered if more "socially useless" financials would go to the wall. Global stock markets were unloved. By 2010 we had a full European sovereign debt crisis developing. In 2012 Mario Draghi pledged to do whatever it takes. 4 shocking years changed investment thinking completely. These events still colour the way markets react today. The reason no one tried Fiscal policy 7 years ago were fears it would reignite the Sovereign Debt Crisis. But, that's a European problem. They no longer hold their own keys to the money printing presses. The UK and US do.

Since the Big Crisis global stock markets have recovered, and the global economy has utterly changed. While Oriental economies have been posting spectacular growth numbers, we've seen wheezing, lethargic "lower for longer" recovery in Europe and the US. It's changed the balance of trade. Despite slow growth, stock markets are close to record levels, fuelled by buy-backs paid for through corporate binge-borrowing!

There are all kinds of reasons why growth has been so lackadaisical in the occidental economies – a mix of over-hasty reactive bank regulation that made bank lending more difficult, the insanity of pumping billions into financial assets to reflate economies even as countries adopted deflationary Austerity spending as a response to the debt crisis, and the increasing bureaucratization of finance. Who knows why growth was so weak, but.. it really doesn't matter.

What matters is where do we go from here!

The point is to acknowledge the world is dynamically changing. Disruptive new technologies are now mainstream and have spawned new economic and manufacturing revolutions. A great example is Telsa: it may be a disaster of a car company, but it's made 100 years of automotive tech obsolete and about as relevant as the horse drawn carriage. Financial Darwinism is occurring across all sectors – adapt, change or die. New opportunities from AI, VR and 3D are there to be exploited or missed. Decisions made today about climate change dictate our grandkids futures. Taking advantage of these opportunities is about smart business, but also smart governments in making sure we have healthy, well-educated workforces available to crew them.

We are likely to living with ultra-low interest rates for the long-term, but real money investors can't meet their pension liabilities on 2% US Bonds or Negative Bund yields. The World has changed, and investment rules have changed with them. Investors need something more attractive to invest in – and why not invest long-term by taking long-term direct stakes in the changing economy? I'd argue GDP growth is irrelevant, while social wealth – creating new well-paid tech jobs, solving climate change while addressing change is far more pertinent.

And it requires government and private sector investment – coordinated fiscal spending/investment! Government money is often squandered – sucked into high-spending internal bureaucracies like health and education without really considering how these vital areas of state provision are also evolving and their financial needs changing – ie why prioritise maternity wings when the biggest challenge is the elderly care? My experience bringing private investors into projects to finance them is their due diligence is the key to successful investments. I suggest the market's diligence can rein-in unwise government spending.

The challenge before a state today is the same as business – evolve to the new opportunities. Markets understand that – so why not encourage private investment into state social and economic infrastructure? Sure, that model was discredited with PPI in the UK – but let's learn why and evolve better ways of doing it.

I reckon new fiscal spending initiatives in economic and social infrastructure could transform the UK and US. The problem is politics – can these countries get past political gridlock in Washington and Brexit in the UK? I am far less certain on Europe – I wrote recently I'd become a Euro Bull when I see some kind of Fiscal equivalent to the Euro emerge. German friends assured me it was going to happen, but since then they've said Germany is growing more insular and its less likely. Sorry to say it but without Germany supporting fiscal policy, then Europe is doomed, and so is Germany. They may be great engineers, but lack the financial imagination to see what's wrong with their horse-drawn carriage economy!

Here's my thinking. I want to retire in a few years time. I want a decent pension. But I can't get that from Gilts at these levels. Do I chose dividend yields from stocks, or do I look to my pension fund investing in long-term income producing assets diversified across private and public assets… Why not indeed? Why shouldn't my pension be dependent on a university churning out valuable well trained engineers and techs to run AI and Robotic factories 3 D printing new Electric power cells. Or do we just leave it unchanged and spend billions producing yet more General Studies graduates with the economic potential of a lump of coal?

I suppose my point is that what we once believed about states reining back spending and where markets are is no longer relevant in the new age. Society must evolve in line with evolving economies – and that's a government function.

If the last 10 years have been about unwise monetary experimentation and financial repression. Will the coming years represent a return to sanity? Perhaps. Time for a good dose of fiscal policy. Its ok for countries to borrow – as long as they do it well, and spend the money wisely. That's why I'm confident there are great investment opportunities coming!

Blain's Brexit Watch

The UK remains in stand-off mode with Europe. The odds of a destabilising No-Deal get higher ever day. Any deal would be a great thing.

I increasingly sympathise with the BoJo government. The UK parliament repeatedly rejected the deal Theresa May "agreed" with Europe on the basis of the backstop. Even Boris and his mob finally vote for it – and it still failed. That should make clear to Brussels the Backstop is simply not acceptable to the UK. If Europe won't change, then no deal it is.

Brussels can argue there is no point in negotiating away the backstop – Boris lacks a solid majority to get it passed in parliament anyway. Brussels is betting the Remainers in Parliament will cause the government to fall, a general election and a second referendum that might go their way. If that happens… we should all hang our heads in shame at the death of democracy.

If would be much much much better to get a deal – and it will hurt no one, except dent the Irish Teashop's pride and a few Brussels egos.

Get over it and talk!

Commenti

Posta un commento