Following last night's deflationary print in China PPI (and super-inflationary food CPI print) from China, all eyes are back on the US hoping for some dismal producer price data offering Powell more 'data' to be 'dependent' on.

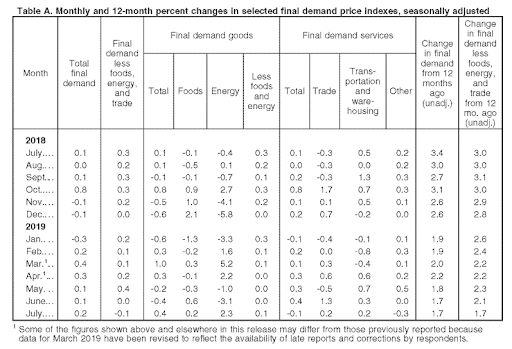

And 'they' were given just that - a dismal miss on core PPI (even if the headline was in line), with Final Demand rising just 1.7% YoY - the weakest since January 2017.

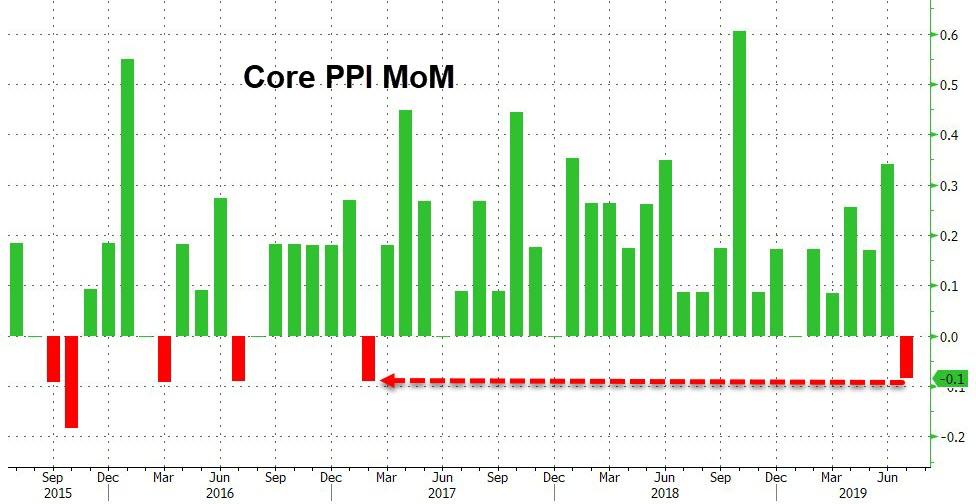

PPI ex food and energy slipped 0.1% MoM (against expectations for a 0.1% rise) - the first monthly deflation since early 2017...

But it was the ex-food, energy, and trade services that really tumbled (slowing from +2.1% YoY to +1.7% YoY).

The cost of goods rose 0.4% after falling 0.4% the previous month. Services prices decreased 0.1% after a 0.4% gain in June.

We await yet another tweet from President Trump proclaiming the lack of inflation and demanding action from The Fed.

Commenti

Posta un commento