Financial markets are raising risks of recession. Equities continue to slide and volatility has spiked, but the alarm bell is loudest in rates markets, where the yield curve inverted the most since just before the start of the financial crisis.

Not all indicators are as bearish as the yield curve, however. While equities have sold off rapidly since last week, the sell-off late last year was much larger only to recover just as rapidly.

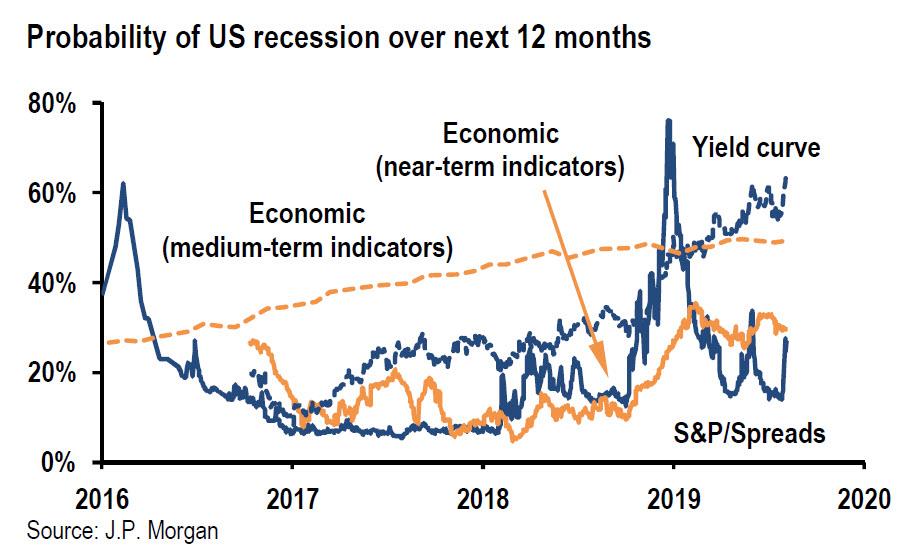

More importantly, while the economic data highlight elevated recession risk, the likelihood of a downturn in the coming 12 months is still below 50%. Within the economic data, the near-term indicators are even less downbeat than the lower frequency signals coming from the low unemployment rate and recent decline in the profit margin.

Bottom line, we are more concerned than we were last week that economic momentum is slowing but not as concerned as the alarm bolting through rates markets. While recognizing economic data can be too backward-looking during times of rapid change, we stick with our macro indicators and see the odds of US (and global) recession in the coming 12 months closer to 40% (the average of our near-term and medium-term indicators).

At the same time, we continue to flag downside risk to our modal growth outlook as the latest data and likely hit to sentiment from the recent trade war escalation and financial market moves suggest global growth running below our forecast of 2.5% in 2H19.

Commenti

Posta un commento