Following Tuesday night's surprise 50 bp rate cut by the RBNZ, Central banks from Wellington to Bangkok are shocking the global economy by slashing interest rates as much of the world braces for an epic downturn.

In the US alone, the recession risk is "much higher than it needs to be and much higher than it was two months ago," said Lawrence Summers, a former US Treasury secretary and a White House economic adviser during the last downturn, told Bloomberg Television.

"You can often play with fire and not have anything untoward happen, but if you do it too much you eventually get burned."

Summers, who teaches at Harvard, warns, the yield curve, for both the US and German economies have flashed warning signs of downturns.

According to Fox Business, one of Wall Street's favorite indicators of a looming recession, the spread between the three-month and 10-year Treasury yields, just flashed its most serious warning about a coming downturn since 2007.

Source: Bloomberg

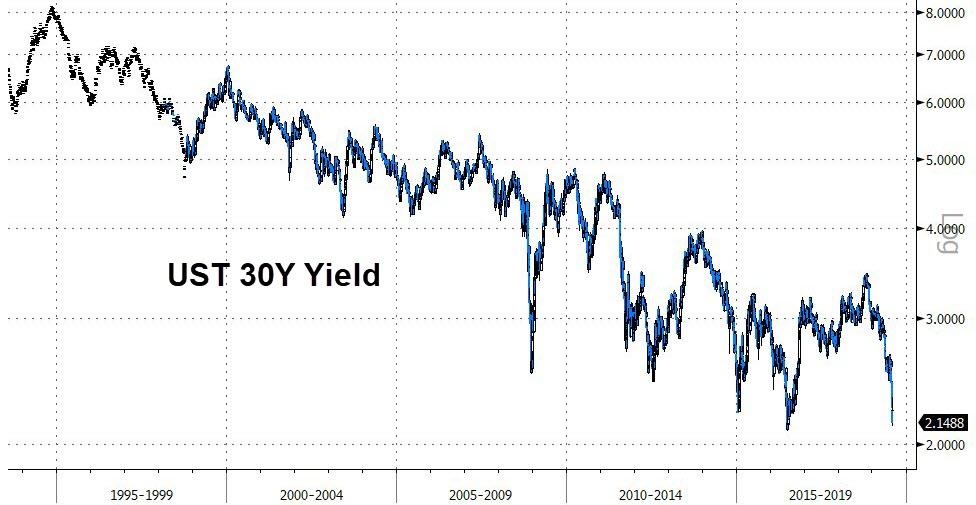

Meanwhile, the yield on the 30-year Treasury bond has almost never been lower - except in 2016, when the yield closed on 2.08% in July 2016.

"We have gone from some degree of uncertainty to bucket loads of uncertainty yet again," said Fraser Howie, who has two decades of experience in China's financial markets and co-wrote the 2010 book "Red Capitalism."

Source: Bloomberg

While tight labor markets globally and the recent shift by central banks should provide a cushion, economists are starting to war game for how a recession could happen. Their fears are mainly centered on recession.

"With no end in sight, there are significant downside risks to our forecasts for U.S. and global growth," Bank of America Corp. economists warned clients this week.

"If the trade war escalates - this could include a more explicit currency war uncertainty would be considerably higher and financial conditions much tighter."

Under one scenario, US President Donald Trump would carry through with his latest threat to impose 10% tariffs on a further $300 billion of Chinese goods, drawing a retaliation from President Xi Jinping. While the direct cost of those tariffs is likely to be small, it is the uncertainty created by a further escalation of the trade war that could weigh on investment, hiring and ultimately consumption.

Morgan Stanley economists predict that if the US puts ~25% tariffs on all Chinese imports for four to six months and the country hits back, a global economic contraction is likely within three quarters. The tensions also extend beyond the US and China to include Japan and South Korea as well as Britain's future relationship with the European Union.

While central banks would likely cut interest rates and perhaps resume quantitative easing, that may no longer be enough to revive animal spirits this time and governments might not be fast enough to loosen fiscal policy.

Even though the central banks are barely done cleaning up swinging back toward rescue mode, having cut rates a week ago for the first time since 2008, the Federal Reserve is on course to do so again next month and investors price in further action by year-end.This, despite Fed Chairman Jerome Powell's signal that he's undertaking more of a mid-cycle adjustment than a pronounced easing cycle, but we'll see how economists, were they up on top.

Commenti

Posta un commento