It's too bad this isn't Friday. There's a chance that markets might calm down for just a little while and give everyone a breather. Wishful thinking, but if the peace is to be broken, it probably won't come from traders themselves. There seems little impetus to put big money to work establishing new positions. And, despite repeated warnings to the contrary, for investors to respond to recent volatility and dump en masse what they have. Although, this afternoon's 30-year Treasury auction could have an out-sized psychological effect on immediate thinking. The details of its internals will get more scrutiny than usual.

You can't plan for bolts from the blue and that shouldn't change any of your trading decisions. But a weekend of reflection would be welcome because, in the short-run, there isn't likely to be any resolution of the differences that have been driving recent price action.

Aside from all of the obvious geopolitical wrangling the world faces, what can you do when one division claims that academic research shows monetary policy makers are on a sound path to do what they must, and the other says that they've taken leave of their senses?

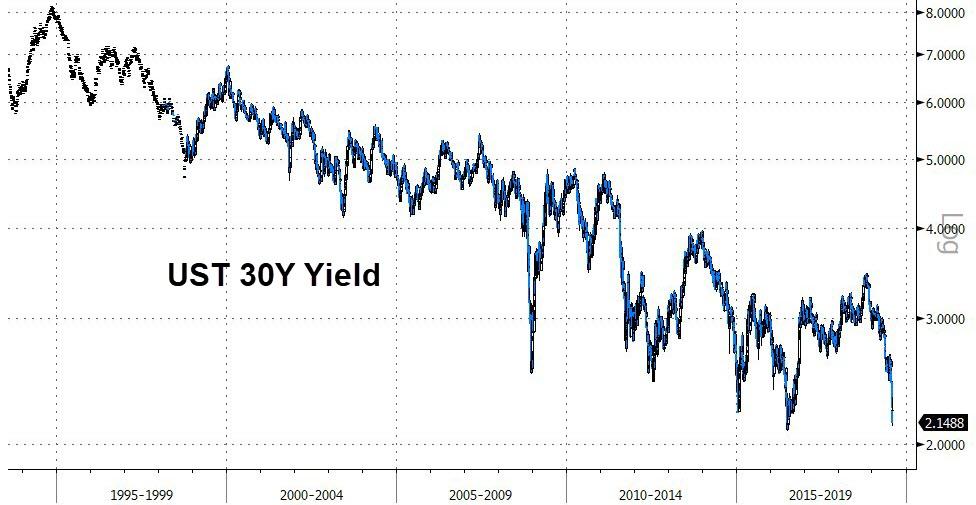

There is little question that Wednesday's one-three punch of aggressive eases by Asian central banks had an unnerving effect on markets. Things have settled down a bit, but bond markets remain very leery. The devil in me couldn't help but idly wonder if the world's monetary policy makers took comfort from what they saw.

Source: Bloomberg

The episode certainly proved the point that if they want global yields to continue to crater, they still very much have the power to do it. For better or for worse. I did think it somewhat more interesting than usual that the appropriately named RBNZ Assistant Governor Christian Hawkesby tempered some of the more dovish conclusions people took away from Governor Adrian Orr's press conference. Test successfully completed.

Source: Bloomberg

But for everyone who said the market went too far, too fast there were more who were reminded that the level of rates won't matter to them if they can expect almost guaranteed price appreciation. Rev your QE engines. The central banks love this mutually beneficial relationship. Especially since no one is thinking terribly hard anymore that there is no escape.

[ZH: bond yields and stock prices have suddenly become more correlated in recent days]

Source: Bloomberg

Did you ever think you would hear this much discussion about the Austrian bond market? And what perfect timing yesterday to be reminded that Japanese investors have continued to buy Italian BTPs in bulk, despite any political risk.

Source: Bloomberg

Investor money continues to flow from active managers into index funds. And there are a lot of reasons, like performance and fees, that make this understandable. Yet, I keep thinking that a lot of people moving their funds can't help but agree that with asset prices of all stripes at these valuations, they need someone who isn't thinking too hard about it to be hitting the buy button.

Making a segue to a different topic, much was made of the fact that today's CNY fix was slightly better than the models suggested. The take away shouldn't be that they were trying to appease anyone. It was a reminder that, up or down, they remain firmly in control of their currency. I'm not sure which of these two possibilities led to the bounce in Asian currencies. But they needed it. And got it.

Source: Bloomberg

The Dollar and Bloomberg Dollar Indexes seem determined to stay in their straight jackets. That's a shame, but understandable, given the political environment. It will keep other markets more volatile than they need be. Something always has to give. Bullish or bearish, this week's lows in yields should be set as an alert on every terminal.

Commenti

Posta un commento