As Bloomberg notes, the spread of Libor to overnight index swaps should tighten as the Federal Reserve ramps up the reinstated Commercial Paper Funding Facility (CPFF).

Though we think the Fed and the Treasury are generally concerned about liquidity, a freezing of the CP market for industrial companies is a larger risk than for financial firms during the current crisis, in our view.

In 2007-09, asset-backed CP was the major risk, but today that's less of a worry.

Industrial companies have few options other than CP for short-term financing, unlike financials, which can tap the discount window and other liquidity sources.

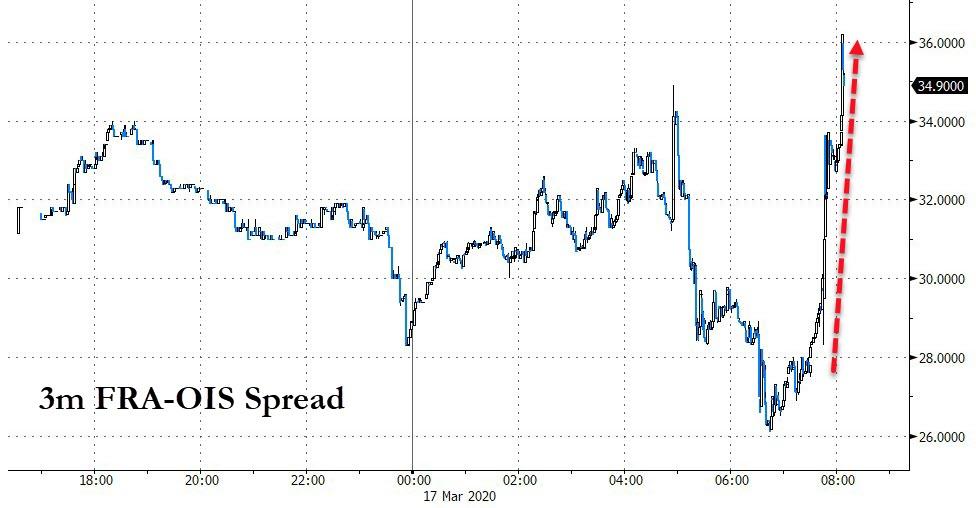

However, the FRA-OIS spread has spiked higher indicating rising stress in the financial system's liquidity markets...

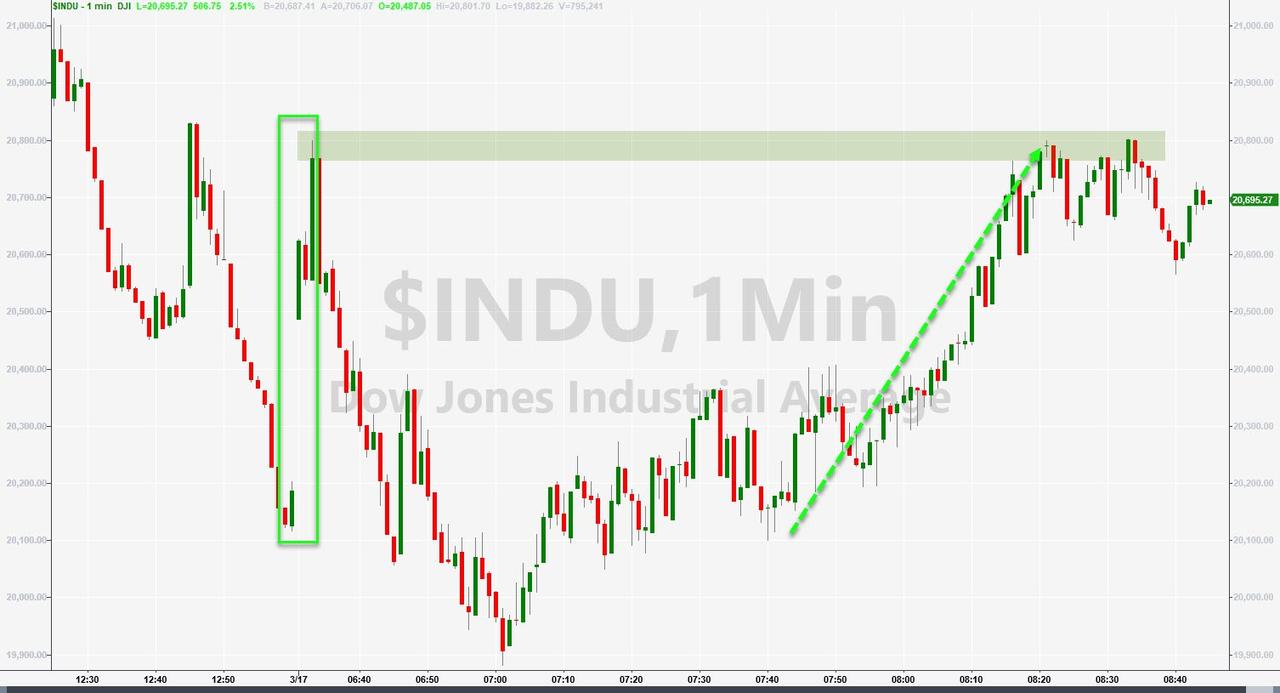

It would appear The Fed's "whack-a-mole" may have 'solved' one problem (corporate liquidity crisis) but the dollar/liquidity shortage in the global financial system is worsening (which is odd, since if companies did not have access to CPFF they would be forced to drawdown all revolvers and crush the financial system further).

Additionally, as BofA warns:

"This facility does nothing to assist the money funds trying to raise cash and address outflows" implying The Fed will have to unleash another backstop.

In fact, the U.S. probably needs a $2 trillion asset-bailout program plus a massive loan program to provide consumer relief and to "salvage viable companies that are struggling," Scott Minerd said Tuesday in a note to clients.

"Given the size of our economy relative to where it was 10–15 years ago, it would probably be appropriate for Congress to pass a TARP-style program of $2 trillion," Minerd said in the note.

Minerd's expectation is that there is no economic growth in the near term, that we've probably already entered a global recession.

Commenti

Posta un commento