* * *

Yesterday's news that the US President was hinting of mediating between Russia and Saudi Arabia in the ongoing oil price war had a positive impact on the oil price. The news lifted risk sentiment in the US session which strengthened in the Asian session. Euro STOXX 50 futures are up 17% from yesterday's lows and up 7% in today's session. EURNOK is significantly lower as well at 11.92 down from 13.18 yesterday which we believe is a good indicator to watch for risk-on sentiment.

Also US companies with weak balance sheets were bid yesterday up 4.7% from open to close and the lows improved significantly from the lows in the prior session. US small caps were part of this rally in equities and our overall view is that this signals real risk taking as these periphery segments of the equity market are the ones that turn first.

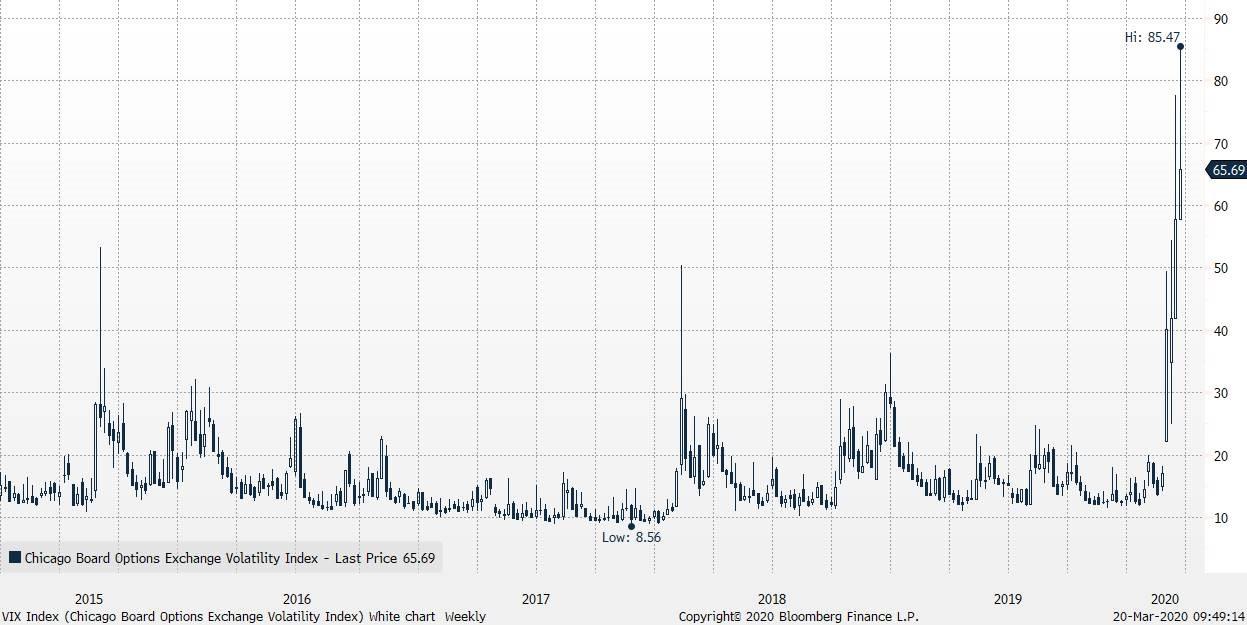

Another important signal to investors is the VIX Index that is quoted at 66 this morning but the May VIX futures contract is also falling maintaining the steepness in the backwardation meaning that long volatility is still seeing tailwind – long VIX futures strategies are up again today in European session. The backwardation in the VIX futures term structure (read here why the VIX futures term structure is important) suggests that we could see more drawdowns in equities but for now short-term we believe risk-on sentiment will dominate.

Overall our view is that global equities have found a short-term bottom here as things are stabilizing and markets are digesting all the stimulus that is coming. However, it's important to clarify that we could still see a lower equity market in the time to come due to all the unknowns related to COVID-19 and its impact on economy and credit.

Commenti

Posta un commento