Reuters took a trip down south and spoke with baby boomers at a retirement community in Florida, many of whom were more concerned about stock market gyrations than the Covid-19 outbreak.

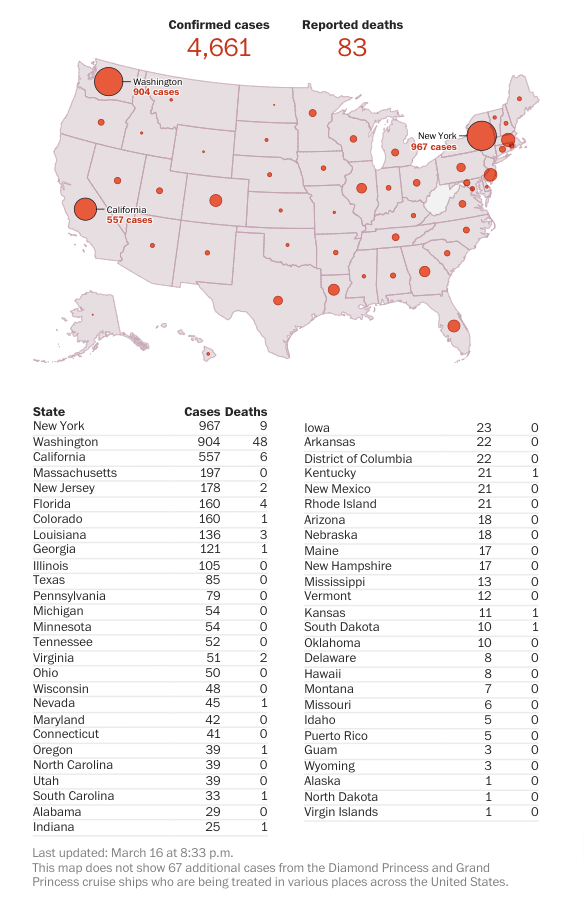

As of Tuesday morning, there are 4,661 confirmed cases and 83 deaths across the country. Florida has recorded 160 confirmed cases and 4 deaths. Containment windows across major metro areas by the government were likely missed last month as community spreading is underway. Social distancing has been implemented in many states to a certain degree to flatten the curve and slowdown infections, but again, the window was missed.

With the fast-spreading virus expected to strike Florida due to its aging population, Reuters interviewed more than a dozen senior citizens at a densely populated retirement community called the Villages. On everyone's mind was not the pandemic consuming the world, but rather their brokerage accounts.

Republican Bruce Casher,68, said Democrats are hyping up the virus to take down President Trump before the election. Democrats want to "crash" the economy, Casher said.

Democrat Andrew Walker,71, said President Trump downplayed the virus and blamed it on Democrats, which shows just how 'unfit' he is as president.

"This is another example of how Trump is unqualified to be president," said Walker.

Former Republican Congressman Carlos Curbelo of Florida said, "If this crisis continues and it's apparent that the government was flawed in its response, then there will be a price to pay."

Curbelo added President Trump was at rallies and told Americans to buy stocks and keep checking their brokerage accounts as a sign of economic prosperity. He said touting the stock market "isn't going to work now."

Several years of the president pumping stocks have likely led to seniors taking on investments that were deemed too risky. Now many are glued to their computer screens, hoping that the stock market crash can reverse into a V-shape recovery.

Mike Vallario, 70, and his wife Trish, 73, said they would self-quarantine if the virus reaches the Villages. Both were confident how the government is handling the crisis, though they're keeping a watchful eye on their retirement portfolios.

Florida is the retirement hub of the country. The crash in the stock market has spooked boomers as a year's worth of gains have been wiped out in a matter of weeks.

In America, or at least just seen at one retirement community in Florida, stock portfolio performance is more important than a pandemic.

Commenti

Posta un commento