New - WH, Mnuchin now discussing stimulus plan worth $1 trillion, per source familiar. Initial estimates of $850B increased after budget crunchers looked at numbers. Would include about $250B worth of checks for Americans

Of that, $500 billion would go directly towards checks for Americans.

Mnuchin doesn't expect checks to go out before the end of April, according to Politico, despite him saying "We're looking at sending checks to Americans immediately" on Tuesday.

Meanwhile, Mnuchin also announced that President Trump has signed off on allowing the deferral of $300 billion in payments to the IRS, according to CNBC.

Mnuchin said if individuals owe a payment, they can defer up to $1 million, and corporations may defer $10 million. The deferrals will be penalty-free for 90 days, he said. -CNBC

Treasury Secretary Steven Mnuchin: President @realDonaldTrump has authorized the deferral of $300 billion in payments to the IRS.

* * *

Update (1230ET): Dr. Birx said during her turn at the mic that young people going to bars and restaurants are seriously jeopardizing the government's response.

If Americans continue going to bars, restaurants and other places, "we will fail in containing this virus."

Dr. Anthony Fauci piled on, saying that the virus "peak" will likely look more like a "hump" if the government response is successful. But young people going out are seriously threatening the health of the vulnerable.

"Please follow the guidelines," he said.

Meanwhile, President Trump, returning to the mic, told reporters that he hoped to send $1,000 to every American. He also took a swipe at spring breakers, saying he was "not happy" about people disobeying the guidelines.

That would cost the Treasury ~$330 billion, plus whatever more in processing fees (tough using 'liberal math', the cost would be much, much higher.

Just to recap: Kudlow gave the market the first whiff of helicopter money yesterday, then Bill Dudley followed that up this morning, along with a few well-placed leaks, with Mnuchin delivering the final touches before sprinting off to the capitol.

And just look how that turned out...

...We call that the 'show us the money' formation.

* * *

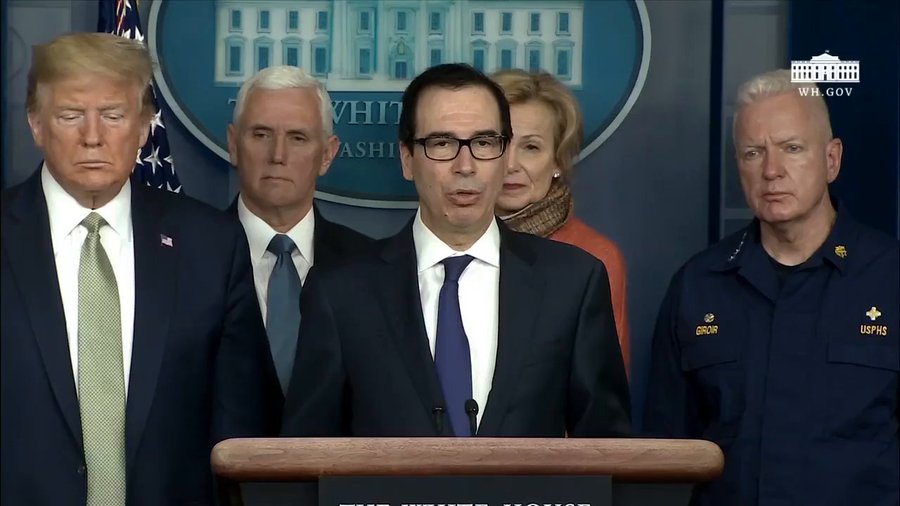

Update (1200ET): After unveiling a plan for the Fed to work with the Treasury to provide $1 trillion in liquidity to the commercial paper market, Mnuchin added that he's working with Congress to plan a "big" rescue package for the public. He wouldn't give an exact figure, but did suggest that it might be larger than the $850 billion figure cited in the press.

The president wants this legislation passed by the end of the week at the latest, and will likely move ahead with sending checks to Americans within the next two weeks as part of the "very significant" package that will be presented to Congress today.

Payments should be looked as "business interruption payments" for Americans, Mnuchin said. Asked who would receive the checks, Trump said most Americans would, though those making "a million dollars a year" probably wouldn't.

"We want to make sure Americans get money in their pockets quickly," he added.

The plan will also include money for small businesses, as well as loan guarantees to airlines and tourism companies.

"We don't want airlines going out of business," Mnuchin said, adding that this crisis was "worse than 9/11" for the airlines.

Speaking of 9/11, Mnuchin insisted he wanted to set one thing straight before running off to Capitol Hill: The Treasury Secretary insisted that the market would not close because of the coronavirus, and that banks would stay open, even if they instituted shorter hours.

"The only reason the market closed after 9/11 was because the technology was disrupted...but Americans should know, we are going to do everything to make sure that Americans will have access to the money in their stocks, in their 401(k)s and their portfolios," Mnuchin said.

Stocks climbed to their session highs on the news, as the White House continues to move closer to where traders want it to be regarding fiscal stimulus.

* * *

With US stocks back in the green, White House is holding yet another press conference to discuss the latest progress in the response. Will Trump announce the massive $850 billion stimulus package that has been kicking around all morning?

Watch live.

Commenti

Posta un commento