Below, courtesy of BofA CIO Michael Hartnett, are several other stunning observations on the Crash of 2020:

- Calls for Fed corporate bond buying, New Deal fiscal policies, new Plaza Accord to stabilize US$, closure of stock exchange coincide with week of Wall St devastation.

- Peak-to-trough crash in global equity market cap = $24tn (c/o US GDP = $22tn).

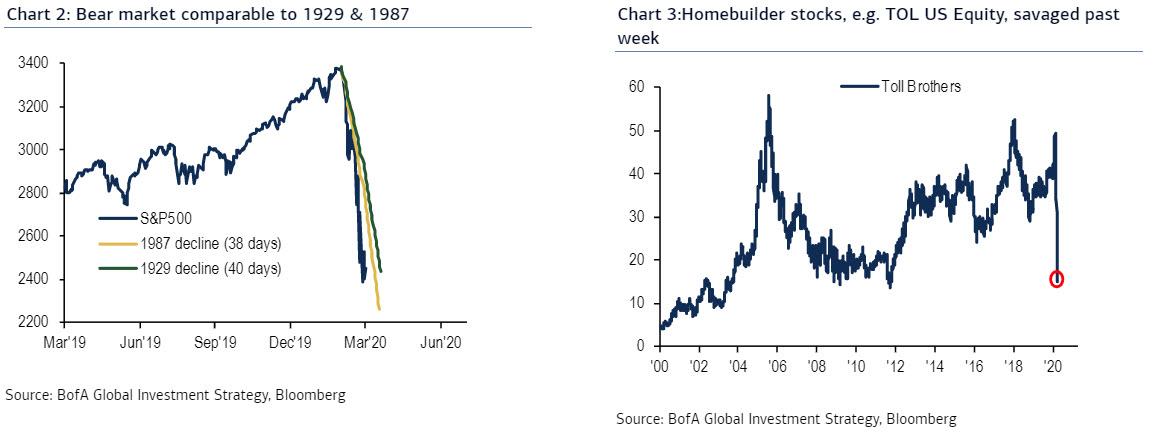

- Monday's 12.0% drop Dow Jones = 3rd largest crash all-time (c/o -20.5% Oct 19th 1987, -12.9% Oct 28th 1929 - Chart 2).

- Liquidation of "safe havens" e.g. gold & US Treasuries (TLT ETF sank 20% after oil shock); epic US$ surge reflects funding pressure of excess US$-denominated debt & zero liquidity.

- Leverage in bond & stocks savaged (see REM, PFF, EMB, homebuilders like TOL - Chart 3); bond yields rise + bank stocks fall = classic sign of deflationary bear market.

- Feral Wall St means vicious bear market rallies...WTI oil surged 24% today.

- Stock exchange has closed just 4 occasions: 1914 & WW1, 1933 bank holiday, 1963 Kennedy assassination, 2001 9/11.

- Global "lockdown" on movement people, goods, services unprecedented but note June 1930 passage of protectionist Smoot-Hawley bill saw US stocks -16.5% in one month.

Policy panic: 42 rate cuts since Feb 1st (note was 36 cuts in 2 months following Lehman); average COVID-19 rate cut has been 70bps; massive global central bank liquidity promised with no upper bound; $2.4tn in global fiscal stimulus (2.7% of GDP) in public aid, loan & income commitments (rises to $3.7tn with US Treasury/Senate proposals = 4.2% global GDP); acceleration toward yield curve control, UBI, MMT, industrial intervention...utterly unprecedented stimulus & intervention that will ultimately cause higher inflation expectations.

- Macro: BofA economists & strategists slash GDP & EPS forecasts (Chart 11).

- Note US GDP = $22tn, consumption $15tn so 20% drop in income & spending in 2-month period means GDP -$750bn, US consumption -$500bn.

- Big pressure on corporate sector not to raise prices, cut employment…EPS takes Q2/Q3 strain.

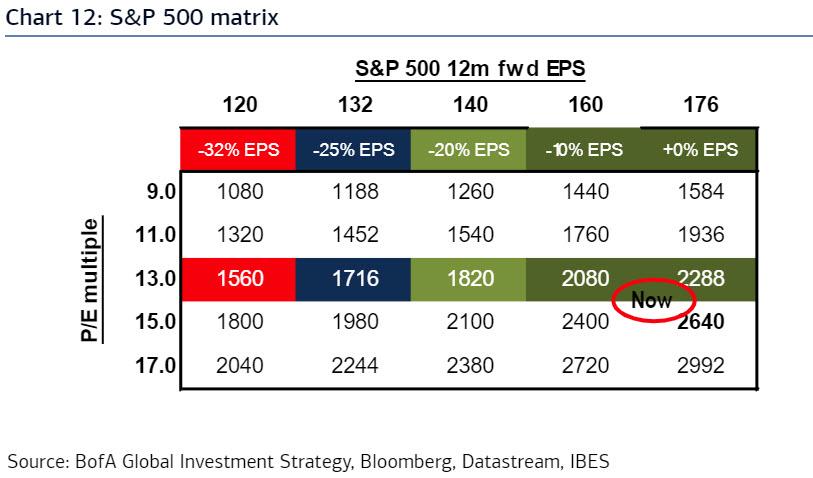

- 2020 SPX EPS of $140 (-20%) generates SPX 2100 on historic mean 15X multiple, SPX 1700 on 12X policy-failure multiple, 2400 on 17X "some policy success" multiple (see Chart 12).

- The "big stuff" will signal virus/recession/default fully-priced...volatility, Treasury yield, credit spreads, oil key.

- The Reckoning: big shocks, big tops, many big political & social changes ahead...localization of supply, relationship with China, new inflationary era, using technology to "live" without human interaction, geopolitical instability of Middle East/Africa, end of era of PE, buybacks, financial engineering, comeback of active vs passive investing.

- Q2 Strategy: aftershocks likely but assets with growth (tech), quality (best of breed stocks), yield (credits with fortress balance sheets) favored.

- Q2 Tactics: policy makers winning "Intervention vs. Deleveraging" war; small cap, cyclicals, oil, banks...bear market rally plays.

Good luck to everyone.

Commenti

Posta un commento