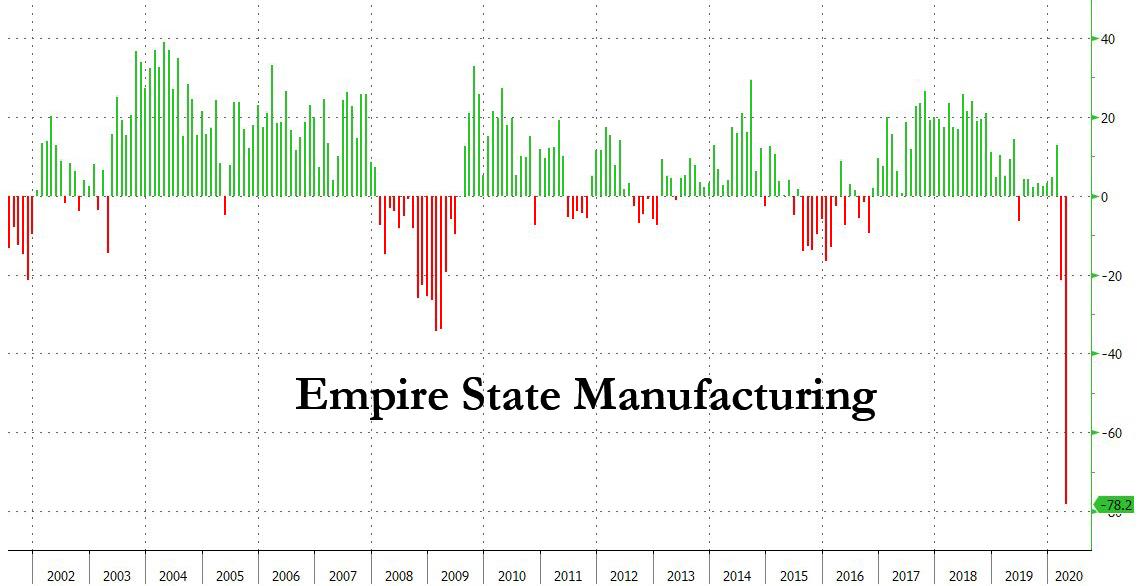

This is what a depression looks like.

With Wall Street already expecting a catastrophic Empire Fed manufacturing index print of -35, just shy of the lows hit during the financial crisis, moments ago the NY Fed reported that New York State business conditions index plummeted fifty-seven points to -78.2, its lowest level in the history of the survey—by a wide margin. The chart says it all: the biggest miss ever, the biggest drop ever, the lowest print ever.

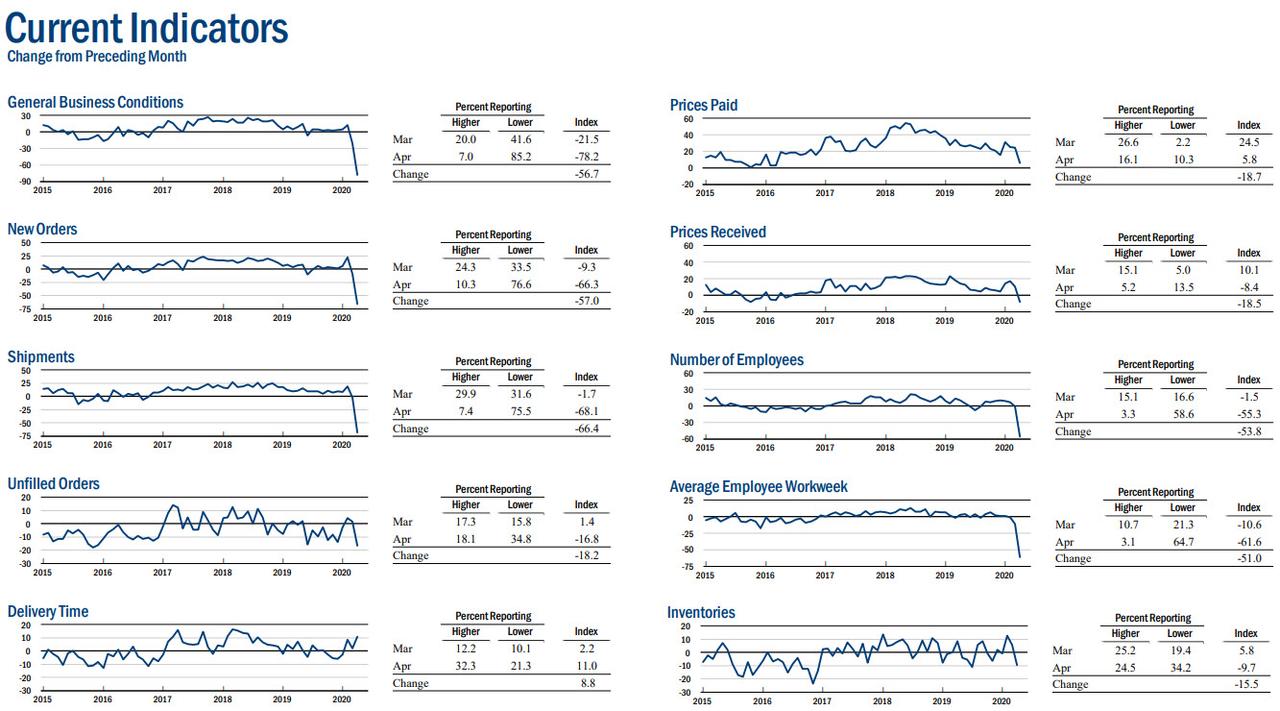

The details below the surface were dire: new orders and shipments declined at a record pace. Delivery times lengthened, and inventories fell. Employment levels and the average workweek both contracted at a record pace. Input price increases slowed considerably, while selling prices declined modestly. As usual, hope dies last and though current conditions were the worst in history, firms expected conditions to be slightly better six months from now.

Some more details: Manufacturing firms in New York State reported that business activity declined dramatically in early April. The general business conditions index fell fifty-seven points to -78.2, its largest point drop to its lowest level on record. By way of comparison, the lowest level this indicator had reached prior to April was -34.3 during the Great Recession.

Seven percent reported that conditions improved over the month, while 85 percent reported that conditions had worsened. The new orders index fell fifty-seven points to -66.3, and the shipments index dropped sixty-six points to -68.1, indicating a sharp decline in both orders and shipments. Delivery times were longer and inventories were modestly lower.

There's more: labor market indicators were extremely weak. The index for number of employees fell fifty-four points to -55.3, with nearly 60 percent of respondents indicating lower employment levels. The average workweek index fell to -61.6, with 65 percent reporting shorter workweeks. The prices paid index fell nineteen points to 5.8, indicating a slowing in input price increases, while the prices received index fell to -8.4, pointing to a decline in selling prices for the first time since 2016.

Looking ahead, firms anticipate a small improvement in business conditions over the next six months. The index for future business conditions edged up six points to 7.0. The indexes for future new orders and future shipments declined, but remained positive, suggesting that firms expect orders and shipments to be modestly higher in six months compared with this month's levels. The capital expenditures and technology spending indexes both fell to -11.0, a sign that firms planned to reduce both kinds of spending.

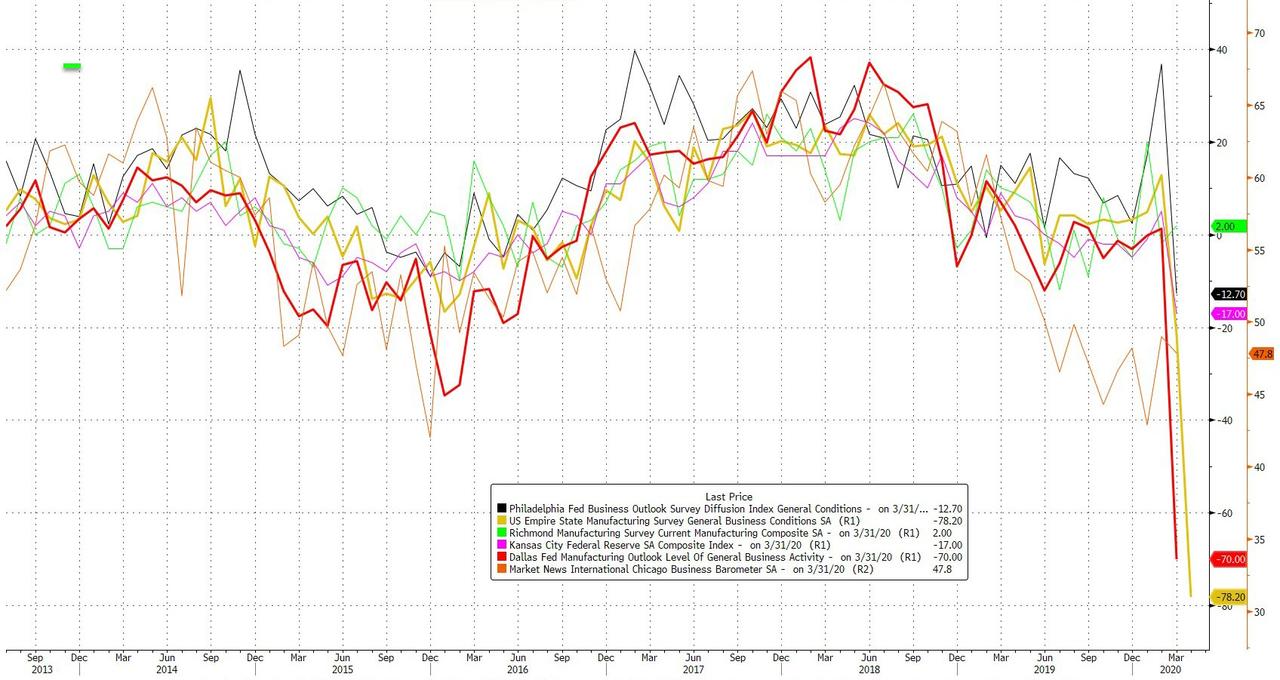

Finally, looking at other regional Fed indexes...

... the pain is only just starting.

Commenti

Posta un commento