In the past three weeks stocks have staged a substantial rebound from their March 24 lows, in big part thanks to an unprecedented barrage of Fed-driven bailouts, backstops, and asset purchases which at last count amount to over $5 trillion in committed capital in just the past month, and also due to the growing conviction that a V-shaped recovery is imminent one the coronacrisis pandemic fades away. Setting aside concerns about a second, even more powerful infection wave, the reality is that a V-shaped recovery - the underlying narrative catalyst for the powerful bear market rally - from the current quarter's GDP plunge which according to JPM will be as big as 40% simply will not happen, and here is Bank of America with a clear and succinct explanation why:

There is a growing narrative in the markets that the end of the crisis is in sight. By some accounts, countries are bending the COVID-19 cases curve, allowing a relatively quick reversal of social distancing policies and a V-shaped recovery in the global economy. In sum, it is time to look through the dark hours ahead and focus on the approaching dawn.

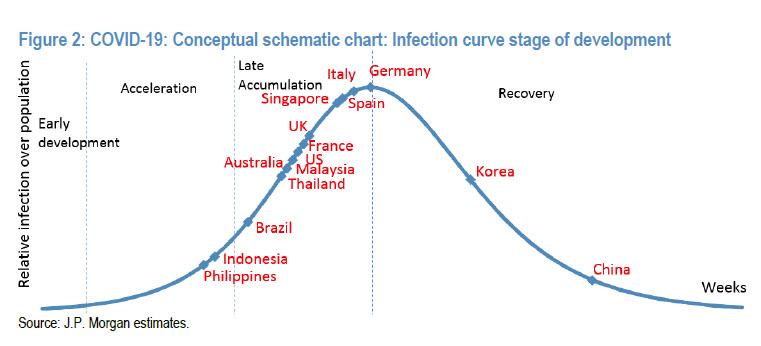

We agree with part of this narrative, but disagree with the bottom line. It does appear that a number of countries and regions are starting to bend the curve. The growth in cases has slowed significantly in most of the Euro area and the biggest hotspot in the US, New York, is showing hints of slowing. Areas that shut down early, like Austria, are now debating what a reopening should look like. Of course, the number of deaths will lag and that ugly reality will be with us longer.

Unfortunately, we are also getting more information on what a reopening looks like and the dangers of premature reengagement. China, with its authoritarian controls on population movement, has opened up significantly in the past six weeks or so and now is roughly at 80% of capacity by some metrics. However, a number of other countries have found it hard to completely reopen their economy even with a much better pandemic health system than in Europe and the US.

In addition, in our view, V-shaped optimists have forgotten a basic lesson of the business cycle. Recessions can be triggered by a variety of shocks-surging oil prices, central bank inflation fighting popping bubbles and now a health crisis-but the recession continues well after the initial shock fades. This is because the drop in activity triggers a nasty feedback loop in the economy that overwhelms the policy easing.

A two- or three-month shutdown will leave lasting scars on confidence. Economies will re-open to a greatly diminished demand environment, with high saving rates and very low discretionary spending. This argues for a U-shaped recovery and a persistent, large output gap, in our view.

If this view is correct, and if the world is indeed stuck in the mire of economic contraction not for a quarter or two, but years, it means that what the Fed has done so far will be insufficient and the next step before Powell & Co., will be to expand its nationalization of capital markets by taking full control of the yield curve - to avoid the crossover point beyond which yields on the long-end of the curve soar - a in the form of Yield Curve Control, something the BOJ has been experimenting with for the past 4 years, and a version of which was used by the Fed in the 1940s, as the NY Fed was kind enough to remind its readers last week (perhaps in a hint of what is coming next). Here is BofA on this very topic:

Global central banks have rolled out an impressive array of stimulus measures. However, as the depth of the downturn becomes clear, it will be hard for them to rest on their laurels. Easing thus far was likely predicated on a nasty recession, but not the worst recession in the post-war period. What do they do next? Negative policy rates look like the very last resort for many central banks given the hot debate over whether they do more harm than good. Therefore the obvious next potential step in our view is to take a page out of the BoJ playbook and implement yield curve control.

Will it be effective and is it worth trying? Yield curve control did not succeed in getting Japan out of its low-rates-low-inflation trap. In our view, this is not because the policy is a waste of time, but because the BoJ only implemented it after deflation psychology was deeply embedded in the economy. It did not help matters that the Japanese government has repeatedly shocked the economy with tax hikes, over the objections of many economists.

Yield curve control has many advantages, in our view. First and foremost, it makes it much easier to control the long end of the curve. Japan was able to keep bond yields low even as it slowed its bond purchases. Second, and related, it makes a replay of the 2013 taper tantrum much less likely. Third, it enhances fiscal stimulus as it prevents the normal rise in interest rates and the "crowding out" of private spending. Fourth, it ensures that as the economy crawls out of the deep hole it has fallen into, rising bond yields do not slow the rebound. Fifth, it would be particularly useful in Europe if the ECB can overcome political hurdles and direct the policy at specific bond markets.

BlackRock's Keenan Sees Long-Term Rates Anchored Near Zero for a Long Time

What BofA did not mention, on purpose, is that any form of Yield Curve Control would terminally crush any forward-looking function the bond market, which is the earliest warning indicator of inflationary (or deflationary) forces across the economy, has. That means that with the yield curve frozen, inflationary imbalances will build up beneath the surface and there will be no way to either observe them or respond to them... besides asset price hyperinflation and soaring gold prices of course.

Effectively, yield curve control in a depressionary world would eliminate one of the two core market-moving drivers of risk prices - market-driven inflation/interest rates - and only leave corporate profits as an indicator of how the economy is doing. However, since the Fed has with its alphabet soup of measures disconnected risk asset prices from corporate fundamentals, i.e., profits and cash flow, by directly purchasing corporate bonds and soon stocks, it is only a matter of time before US capital markets get to a point where no economic or fundemental signals are reflected in risk assets, resulting in a "market" that is if not nationalized, then centrally-planned by the whims of a small group of Fed career economists, most of whom have never held a private sector job and have zero real world experience.

How does such ubiquItious central planning end? Look no further than the USSR for the answer.

Commenti

Posta un commento