Which was to be expected: with the US economy shutting down and Americans forced to isolate themselves in the second half of the month, the print is hardly a surprise.

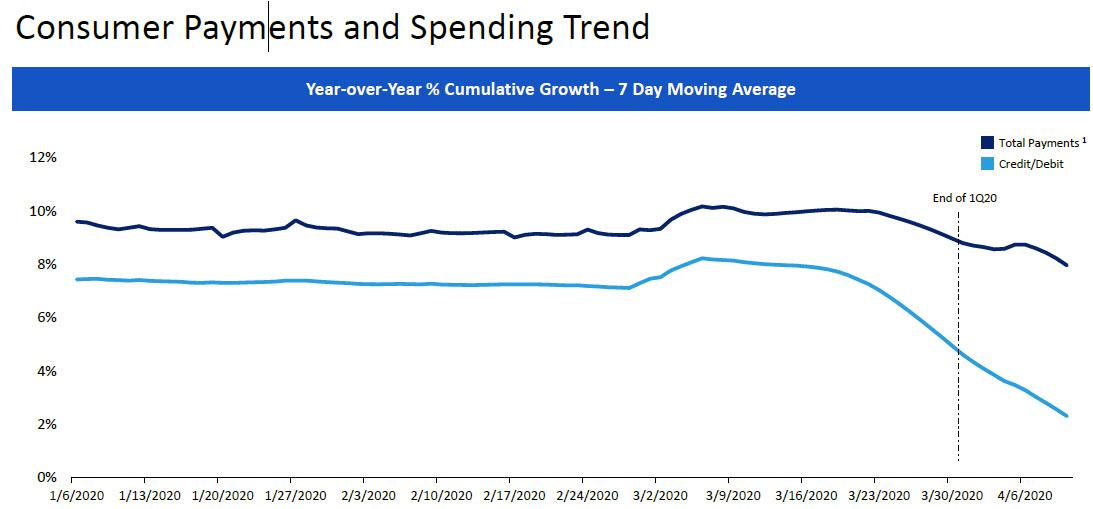

Curiously, some welcome detail was available in this morning's BofA earnings release which showed the trajectory of total consumer payments made within its network (defined as payments include total credit card, debit card, ACH, wires, bill pay, person-to-person, cash and checks), and which showed that after a curious bounce at the start of the month, likely as a result of Americans stockpiling food and non-perishables ahead of the pandemic, spending hit a brick some time around March 18 at which point payments starting dropping but not nearly as fast as many would have expected, and in fact according to BofA as of the second week of April, total payment were still growing at around 8% compared to 2019.

This is how BofA described the change:

- 1Q20 total payments increased 9% over 1Q19, with softening in credit and debit spend that began mid-February and accelerated in late March as stay-at-home orders affected a majority of Americans 1,2

- Card spend for non-essentials declined, even for those not impacted by the pandemic from a cash flow or employment perspective, and purchases of essentials such as groceries increased

- Consumers and Small Businesses paying expenses with other payment types slowed consistently as the stay-at-home orders expanded

Finally, spending via just credit and debit saw a bigger drop, yet even that increased 4% year-over-year in 1Q20 despite the sharp decline in late March.

Why does this matter? Because it means that with the US economy now completely shut for the foreseeable future, it's about to get far worse.

Commenti

Posta un commento