Source: Bloomberg

"The 30-year fixed mortgage rate decreased last week to the lowest level in MBA's survey at 3.45 percent. The decline in rates – despite Treasury yields rising – is a sign that the mortgage-backed securities (MBS) market is stabilizing and lenders are successfully working through their lending pipelines," said Joel Kan, MBA's Associate Vice President of Economic and Industry Forecasting.

"Refinance activity has experienced a volatile four-week period, but did increase 10 percent last week. Refinancing will continue to be beneficial for the many borrowers able to lower their monthly payments during this time of economic distress."

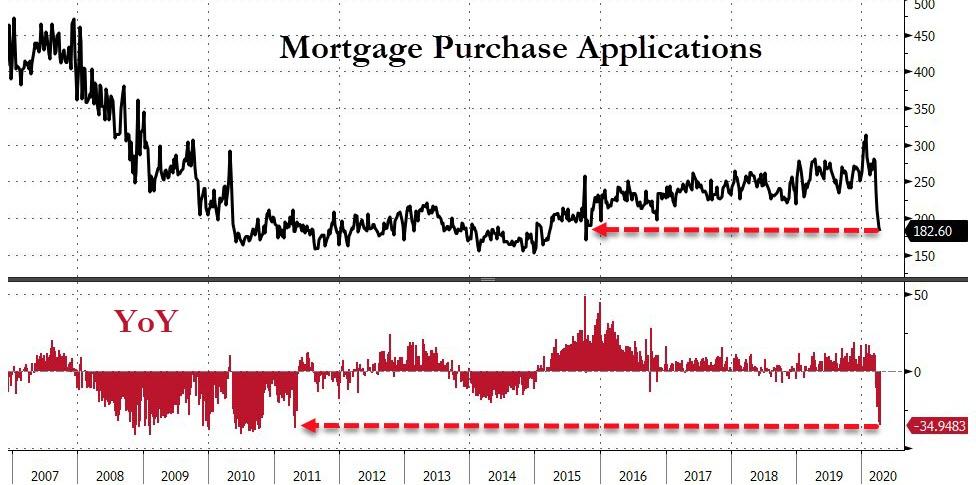

This is the biggest year-over-year crash in purchase applications since 2011...

Source: Bloomberg

Kan desperately attempted to find a silver lining however...

"Purchase applications decreased less than 2 percent last week – the fifth straight weekly decline. Compared to the first week of March, the purchase index was down around 35 percent, as the economic downturn and nationwide mitigation practices to slow the spread of COVID-19 have disrupted the spring homebuying season.

The purchase market is still expected to rebound, as long as the public health measures to reduce the pandemic's spread are successful and result in a broader recovery."

We doubt that Mr. Kan - have you looked at homebuyer (and now homebuilder) sentiment?

After months of ascendance in the face of homebuyer sentiment collapsing, NAHB reports a total collapse in homebuilder sentiment to 30 from 72 (massively worse than the expected 55). This is by far the biggest drop on record...

Source: Bloomberg

All subcomponents collapsed too:

Present single family sales falls to 36 vs 79 last month

Future single family sales falls to 36 vs 75 last month

Prospective buyers traffic falls to 13 vs 56 last month

"While the virus is severely disrupting residential construction and the overall economy, the need and demand for housing remains acute," NAHB Chief Economist Robert Dietz said in a statement.

"As social distancing and other mitigation efforts show signs of easing this health crisis, we expect that housing will play its traditional role of helping to lead the economy out of a recession later in 2020."

So once again, homebuyer sentiment led homebuilder sentiment by months...

Source: Bloomberg

As Upton Sinclair is credited with saying, "it is difficult to get a man to understand something when his salary depends upon his not understanding it..."

That is until, like Mike Tyson said, reality punches you in the mouth and you're forced to shrug off the self-delusion.

And of course, with around 2 million homeowners now in forbearance, this is hardly a positive backdrop for the housing market.

Commenti

Posta un commento