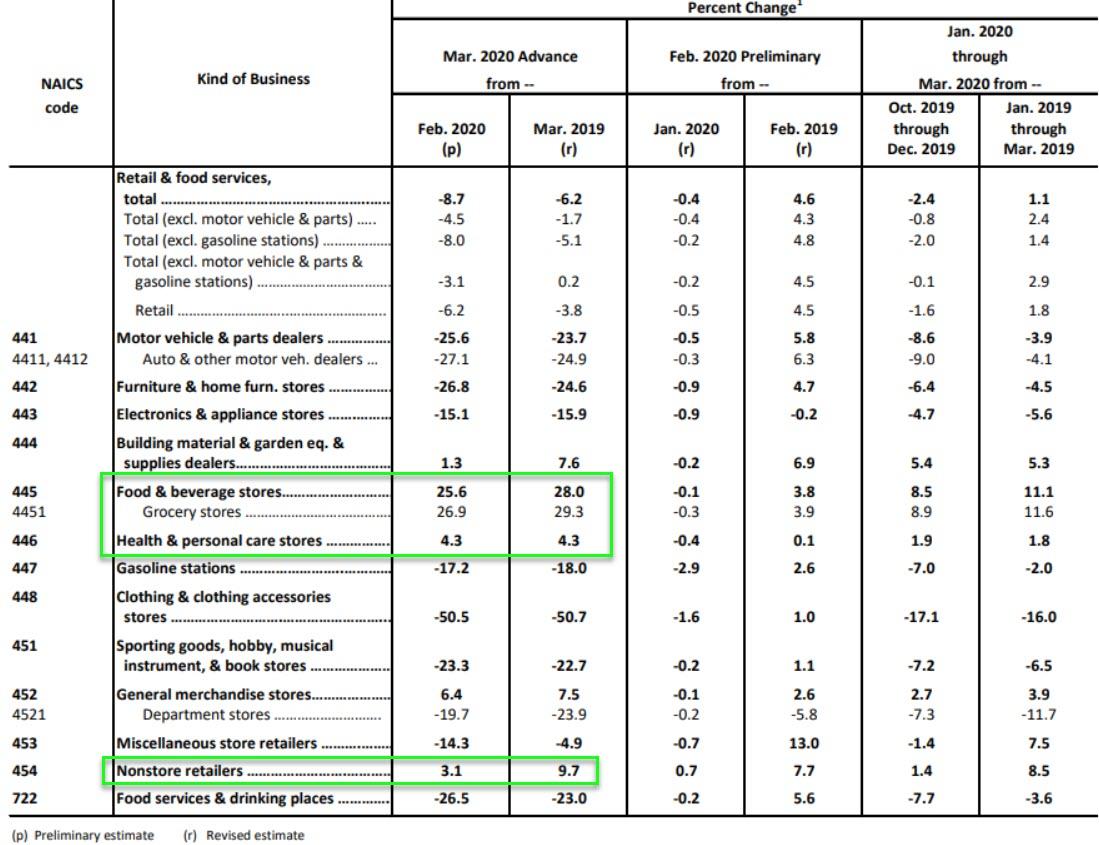

While it is not entirely surprising given that practically all of America is under lockdown and the consumption-focused services sector is particularly distressed, US retail sales crashed 8.7% MoM in March (against expectations of a 8.0% drop)

Source: Bloomberg

Year-over-year, headline retail sales crashed 6.2% - the biggest drop since Sept 2009...

Source: Bloomberg

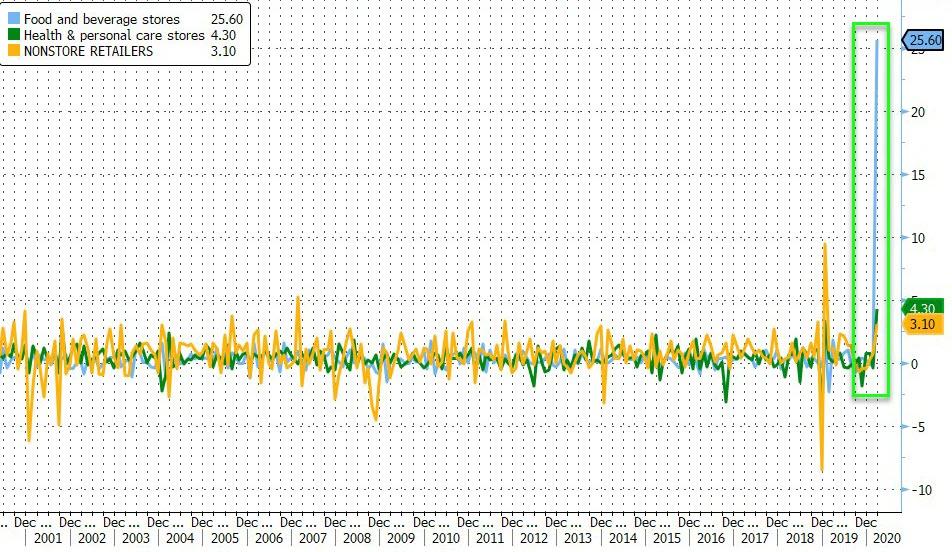

Ex-Autos dropped 4.5% MoM (slightly better than expected) and Ex-Autos-and-Gas dropped 3.1% MoM (again slightly better than expected, and the Control Group (that is used for GDP calculation purposes), somehow managed a 1.7% MoM rise (against expectations of 2.0% drop). The driver appears to be 'hoarding' as food and beverage and health stores saw huge rises in sales...

This was the biggest MoM surge in Food & Beverage store sales ever...

Source: Bloomberg

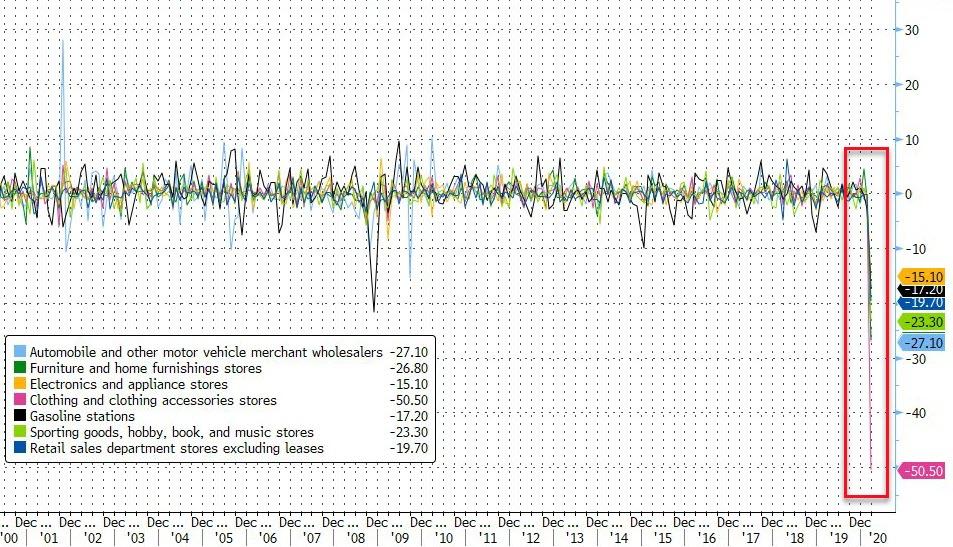

But the scale of hoarding in Food & Beverage is offset by the utter devastation across so many other sectors...

Source: Bloomberg

How long can that lift last? We would be worried about April's data.

Commenti

Posta un commento