Roughly one week after the first reports were published about the Plano Texas-based department store exploring a Chapter 11 filing surfaced, JC Penney is officially filing for bankruptcy, sending its battered shares sliding even lower.

Reuters revealed late last night that a filing is imminent now that the department store chain has had to close all 850 of its stores and furlough its ~95k employees across the US, disrupting a turnaround plan that was - let's be real - probably doomed to fail, anyway.

As the "retail apocalypse" moves into warp speed thanks to the pressures of the novel coronavirus outbreak, a representative for the chain told Reuters that the company probably has enough cash to survive the months ahead, even as revenue dries up because of the store closures. However, the company is considering bankruptcy protection to restructure its finances and get out from under crushing debt payments.

True Religion Jeans Files for Bankruptcy

A decision on Chapter 11 reportedly isn't final, and JCP is reportedly weighing other alternatives, like asking creditors to enter into talks to restructure its debt so it can save money on payments.

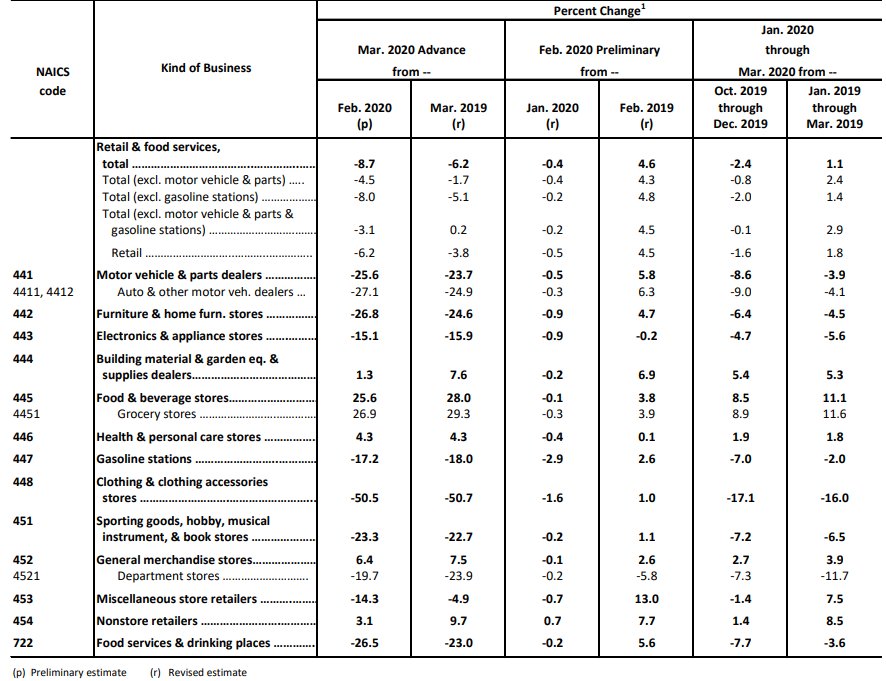

Meanwhile, March retail sales data released Wednesday showed a massive nearly 20% drop in sales at Department Stores across the country.

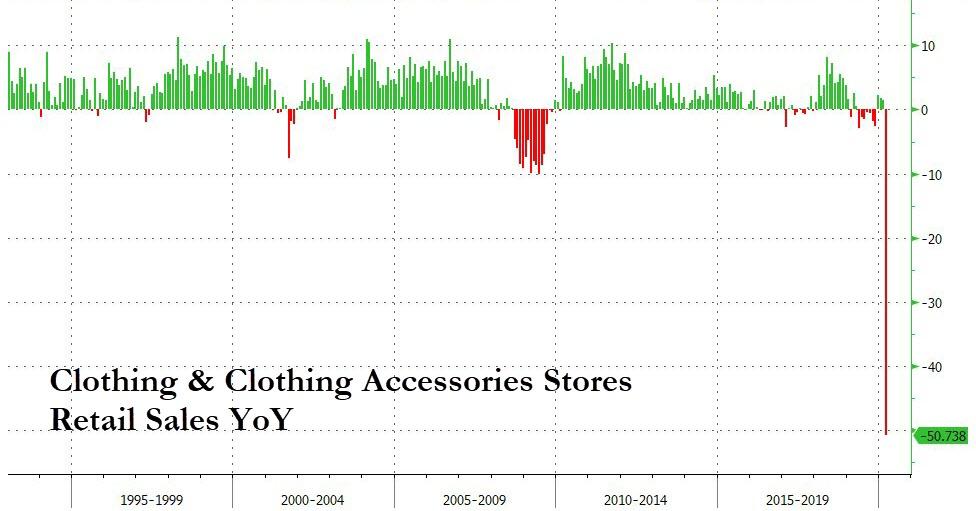

And a 50%-plus plunge in clothing store sales year-over-year...

If the chain does file, that will put even more pressure on malls across the country, as JC Penney stores often serve as major tenants.

No filing has been made, but the report has sent JCP stock spiraling lower, while the cost of insuring the department store's debt has soared.

Commenti

Posta un commento