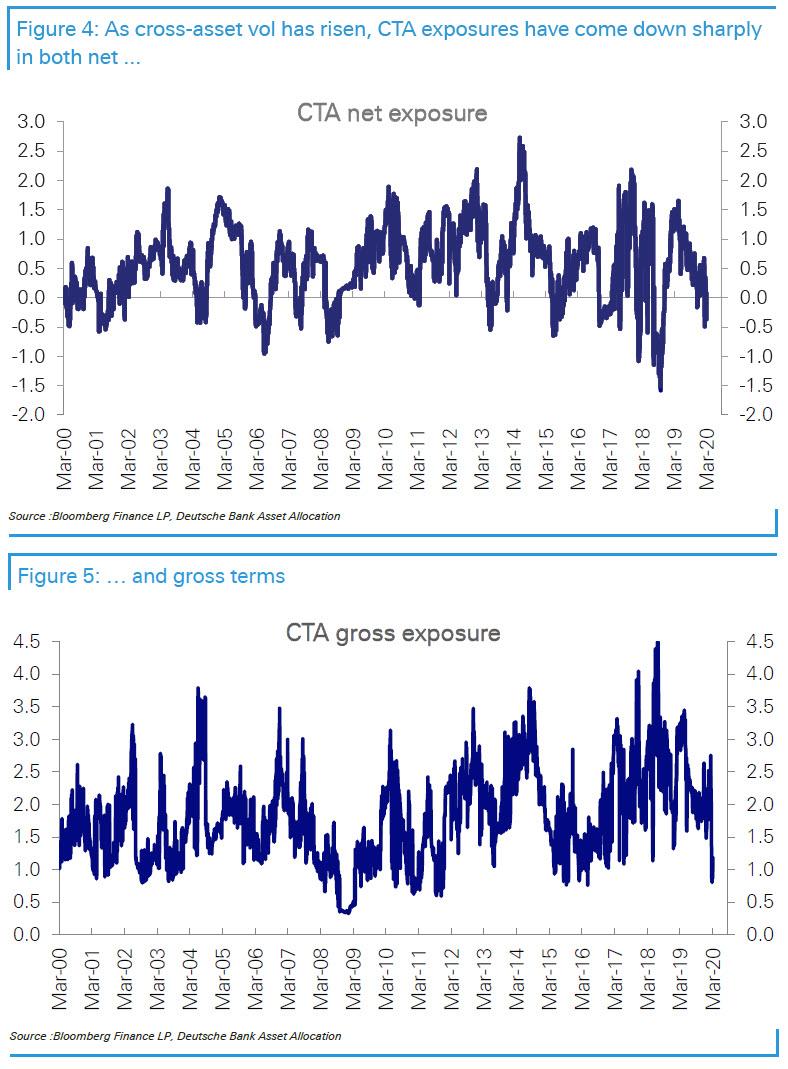

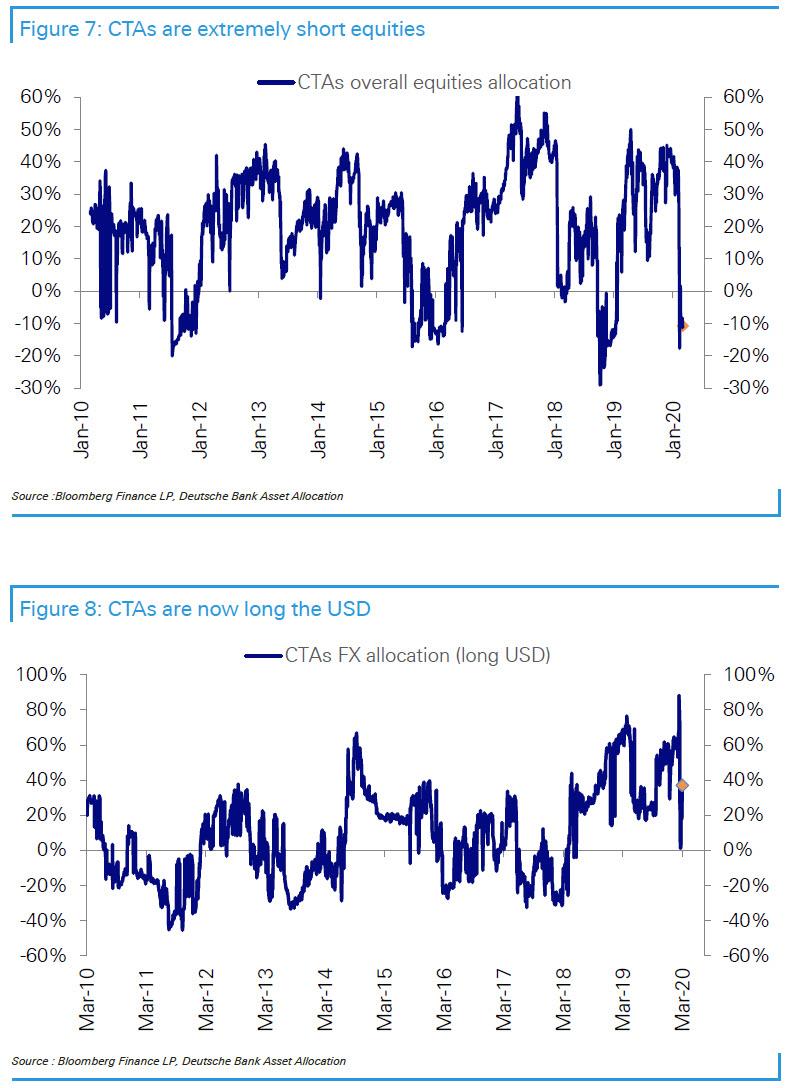

... which are now very short stocks and long the dollar...

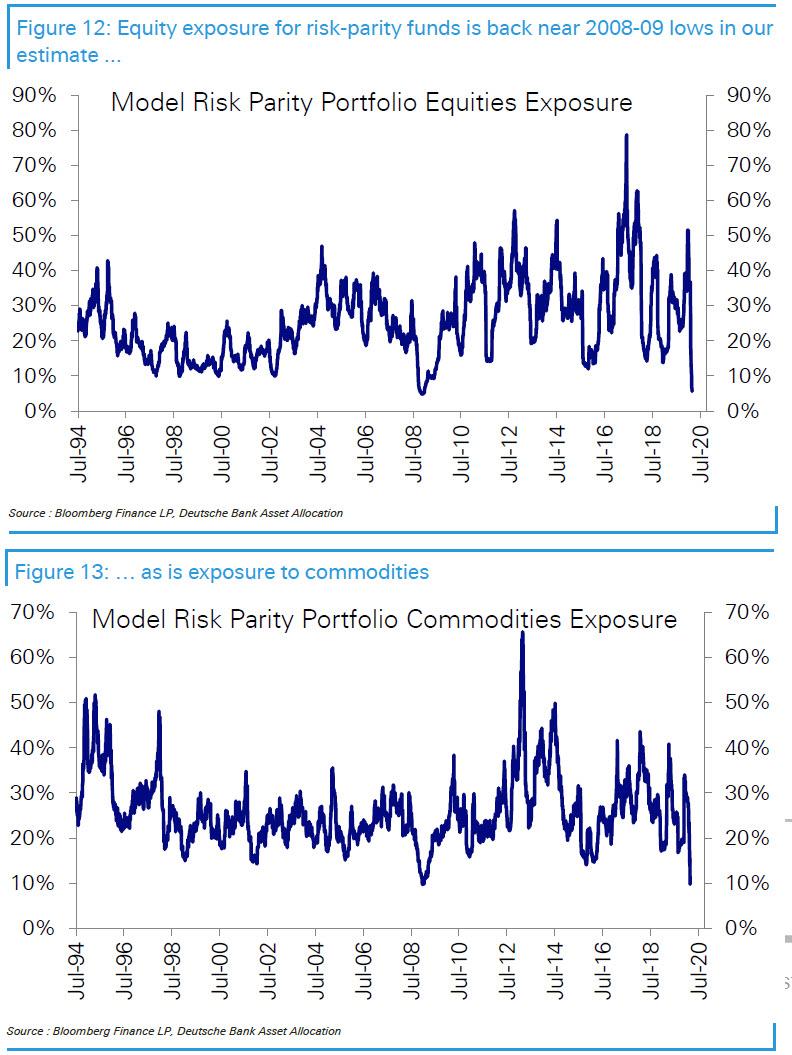

... continuing with risk-parity...

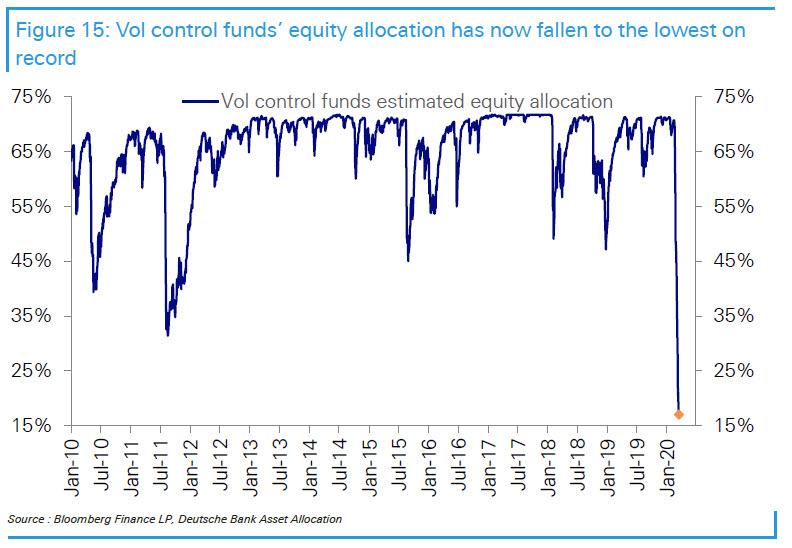

... the vol control...

... the systematic unwind was simply unprecedented, and far beyond the selling observed in the discretionary community.

Of course, this is also good news: it means much if not all of the "algo" selling is now over simply because there is little more left to sell as Charlie McElligott discussed earlier today.

It also means that all that the dip buyers need is a catalyst to unleash a massive buying rampage - as we observed in today's 11% market surge which was the biggest since 1933. And in one specific instance, a group of investors doesn't even need a catalyst as a result of the massive outperformance of bonds relative to stocks in the past month

We are talking about month and quarter-end rebalancing, and according to JPMorgan estimates, balanced or 60:40 mutual funds, a $1.5tr universe in the US and $4.5tr universe globally, need to buy around $300 billion of equities to fully rebalance to 60% equity allocation.

At the same time the $7.5 trillion universe of US defined benefit plans, would need to buy $400 billion to fully rebalance and revert to pre-virus equity allocations.

Finally, there are the "balanced" sovereign pension funds such as Norges bank and GPIF, which before the correction had assets of around $1.1tr and $1.5tr, respectively, and which according to JPM would need to buy around $150 billion equities to fully revert to their target equity allocations of 70% and 50%, respectively.

While JPM admits that the timing of these rebalancing flows is uncertain, it is likely to take place over the coming days and ahead of March 31. As JPMorgan concludes, "$850 billion of pending rebalancing flows is done over the next few weeks that should also help to reduce vol and to lift equity prices higher from here."

The only question is whether much if not all of this massive rebalance took place during today's historic surge. If so, those hoping for an invisible hand pushing stock higher into month end may be very disappointed, especially if Congress is unable to come out with any credible stimulus package.

Commenti

Posta un commento