President Trump is weighing whether or not to ease restrictions on self-quarantine in order to avoid economic chaos - tweeting on Sunday about reassessing the nation's course on a lockdown to halt the spread of coronavirus.

WE CANNOT LET THE CURE BE WORSE THAN THE PROBLEM ITSELF. AT THE END OF THE 15 DAY PERIOD, WE WILL MAKE A DECISION AS TO WHICH WAY WE WANT TO GO!

According to Bloomberg, Trump began talking privately late last week about reopening the nation after a 15-day waiting period, as coronavirus cases continue to rise - going against the advice of health professionals such as Dr. Anthony S. Fauci, who says we need to continue the lockdown for a 'few more weeks.'

Trump and a contingent of his aides, including Treasury Secretary Steven Mnuchin, want to ensure that the economic damage from a nationwide "social distancing" campaign doesn't outweigh the potential toll from the virus itself, the people said. -Bloomberg

Once the 15-day period ends, discussions have centered around isolating everyone who's sick or at high risk so that healthy people can return to work. Bloomberg says that the CDC guidelines would be 'relaxed' and not scrapped altogether.

According to the report, the government's top health officials say that sustained and economically detrimental restrictions on daily life are the only way to beat the virus in lieu of a successful treatment or a vaccine.

This group is led by Deborah Birx, the State Department doctor tapped to advise Vice President Mike Penceon the government's response to the outbreak, and Anthony Fauci, the influential director of the National Institute of Allergy and Infectious Diseases. -Bloomberg

On Monday morning, Trump began retweeting several accounts who have promoted the idea that an economic depression caused by a collapse in productivity and consumption, and a spike in unemployment, may be worse than the virus itself.

Robert, we will end up stronger than ever before. Thank you! twitter.com/barnes_law/sta…

Surprise! Destruction of the economy leads to less traffic and pollution. twitter.com/nytimes/status…

Correct. 15 days, then we keep the high risk groups protected as necessary and the rest of us go back to work.

President Trump has been retweeting accounts this morning suggesting he doesn't want to keep shutdown longer than 15 days. That impulse could put him at odds with medical experts like Dr. Fauci, who says we may have to stay home for "several more weeks:" google.com/amp/s/www.nbcn… twitter.com/fedupmil/statu…

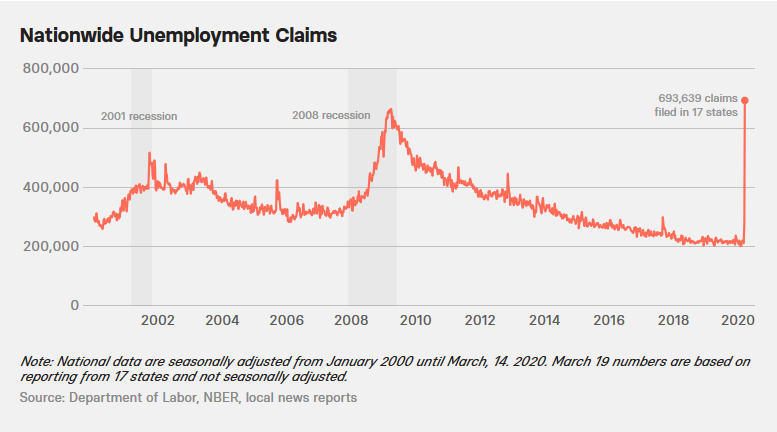

According to St. Louis Federal Reserve Bank President James Bullard, the US unemployment rate may hit 30% in the second quarter, coinciding with a 50% drop in GDP.

Morgan Stanley, meanwhile, said on Sunday that it expects the US economy to crater to the tune of 30% in Q2.

There were more than 35,000 cases officially counted in the US as of Monday and over 400 deaths, according to Johns Hopkins University's coronavirus tracker.

Extreme measures to flatten the virus "curve" is sensible-for a time-to stretch out the strain on health infrastructure. But crushing the economy, jobs and morale is also a health issue-and beyond. Within a very few weeks let those with a lower risk to the disease return to work.

As Bloomberg notes, former senior Trump aid Steve Bannon is on the other side of the argument - and says that America needs to take even more stringent measures to halt the spread of the virus by limiting social contact, or face insurmountable economic damage.

"We're going to have to take the pain up-front. We're going to have to shut it all down," Bannon told Fox News on Sunday.

Commenti

Posta un commento