Despite unprecedented actions by The Fed:

The FOMC expanded its large scale asset purchase program by promising to purchase 'in the amounts needed.' Previously, the FOMC had said it would purchase at least $500bn of Treasury securities and at least $200bn of agency MBS. The FOMC also announced that the agency MBS purchases will include agency commercial MBS.

The Fed also made CPFF more generous in terms of pricing and opened CPFF and MMLF to a wider set of assets.

The Board of Governors relaunched the Term Asset-Backed Securities Loan Facility (TALF), providing loans in exchange for ABS.

Two novel facilities are the Primary Market Corporate Credit Facility (PMCCF) and the Secondary Market Corporate Credit Facility (SMCCF). We are likely to see an increased contribution by the Treasury Department to these facilities once the big fiscal stimulus has been signed.

The dollar funding crisis is rapidly re-accelerating as month-end looms... having erased all of the 'improvement' offered by The Fed...

Source: Bloomberg

So, the question is simple - How can the Fed launch an "unlimited" monetary stimulus with congress approving a $2 trillion package and the dollar index remain strong?

The answer, as Daniel Lacalle details below, lies in the rising global dollar shortage, and should be a lesson for monetary alchemists around the world.

The $2 trillion stimulus package agreed by Congress is around 10% of GDP and, if we include the Fed borrowing facilities for working capital, it means $6 trillion in liquidity for consumers and firms over the next nine months.

The stimulus package approved by Congress is made up of the next key items: Permanent fiscal transfers to households and firms of almost $5 trillion. Individuals will receive a $1,200 cash payment ($300 billion in total). The loans for small businesses, which become grants if jobs are maintained ($367 billion). Increase in unemployment insurance payments which now cover 100% of lost wages for four months ($200 billion). $100 billion for the healthcare system, as well as $150bn for state and local governments. The remainder of the package comes from temporary liquidity support to households and firms, including tax delays and waivers. Finally, the use of the Treasury's Exchange Stabilization Fund for $500bn of loans for non-financial firms.

To this, we must add the massive quantitative easing program announced by the Fed.

First, we must understand that the word "unlimited" is only a communication tool. It is not unlimited. It is limited by the confidence and demand of US dollars.

I have had the pleasure of working with several members of the Federal Reserve, and the truth is that it is not unlimited. But they know that communication matters.

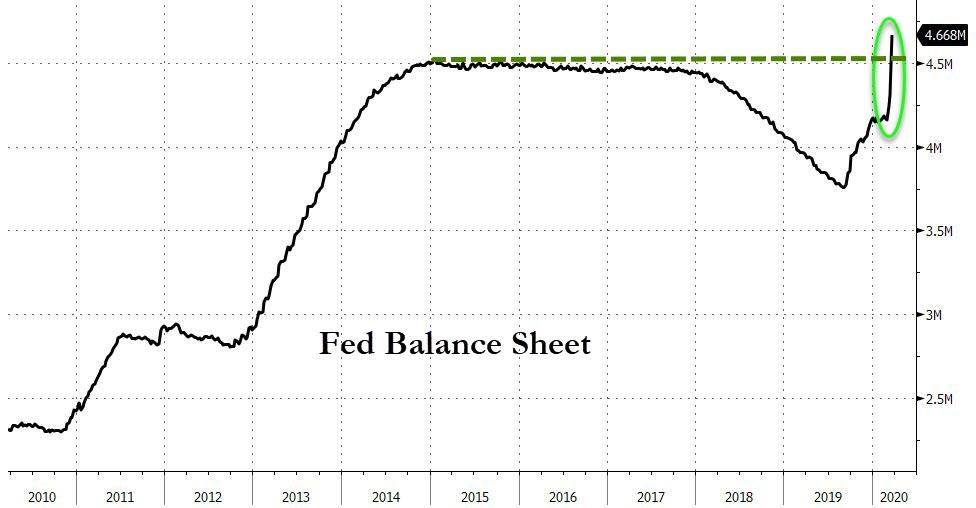

FED BALANCE SHEET 25TH MARCH 2020

The Federal Reserve has identified the Achilles heel of the world economy: the enormous global shortage of dollars. The global dollar shortage is estimated to be $ 13 trillion now, if we deduct dollar-based liabilities from money supply including reserves.

How did we reach such a dollar shortage? In the past 20 years, dollar-denominated debt in emerging and developed economies, led by China, has exploded. The reason is simple, domestic and international investors do not accept local currency risk in large quantities knowing that, in an event like what we are currently experiencing, many countries will decide to make huge devaluations and destroy their bondholders.

According to the Bank of International Settlements, the outstanding amount of dollar-denominated bonds issued by emerging and European countries in addition to China has doubled from $30 to $60 trillion between 2008 and 2019. Those countries now face more than $2 trillion of dollar-denominated maturities in the next two years and, in addition, the fall in exports, GDP and the price of commodities has generated a massive hole in dollar revenues for most economies.

If we take the US dollar reserves of the most indebted countries and deduct the outstanding liabilities with the estimated foreign exchange revenues in this crisis … The global dollar shortage may rise from 13 trillions of dollars in March 2020 to $ 20 trillion in December … And that is if we do not estimate a lasting global recession.

China maintains $3 trillion of reserves and is one of the best-prepared countries, but still, those total reserves cover around 60% of existing commitments. If export revenues collapse, dollar scarcity increases. In 2019, Chinese issuers increased their dollar-denominated debt by $ 200 billion as exports slowed.

Gold reserves are not enough. If we look at the main economies' gold reserves, they account for less than 2% of money supply. Russia has the largest gold reserves vs money supply. China's gold reserves: 0.007% of its money supply (M2), Russia's gold reserves: c9% of its money supply. As such, there is no "gold-backed" currency in the world, and the best protected -in gold- the Ruble, suffers the same volatility in commodity slump and recession times as others due to the same issue of US dollar scarcity, although not even close to the volatility of those LatAm countries that face both falling US dollar reserves and a collapse in demand from their own citizens of their domestic currency (as Argentina)..

The Federal Reserve knows that it has the largest bazooka at its disposal because the rest of the world needs at least $ 20 trillion by the end of the year, so it can increase the balance sheet and support a large deficit increase of $10 trillion and the US dollar shortage would remain

The US dollar does not weaken excessively because the rest of the countries are facing a huge loss of reserves while at the same time increasing their monetary base in local currency much faster than the Federal Reserve, but without being a global reserve currency.

Second, the accumulation of gold reserves of the central banks of the past years has been more than offset in a few months by the increase in the monetary base of the world-leading countries. In other words, the gold reserves of many countries have increased but at a much slower rate than their monetary base.

The Federal Reserve knows something else: In the current circumstances and with a global crisis on the horizon, global demand for bonds from emerging countries in local currency will likely collapse, far below their financing needs. Dependence on the US dollar increases. Why? When hundreds of countries try to copy the Federal Reserve printing and cutting rates without having the legal, investment and financial security of the United States, they fall into the trap that I comment in my book Escape from the Central Bank Trap (BEP): ignoring the true demand for their domestic currency.

A country cannot expect to have a global reserve currency and maintain capital controls and investment security gaps at the same time.

The ECB will likely understand this shortly when the huge trade surplus that supports the euro collapses in the face of a crisis. Japan learned that lesson by turning the yen into a currency backed by huge dollar savings and increased its legal and investment security to the standards of the US or UK, despite its own monetary madness.

The race to zero of central banks in their monetary madness is not to see who wins, but who loses first. And those that fail are always the ones who play at being the Fed and the US without their economic freedom, legal certainty, and investor security.

The Federal Reserve can be criticized, and rightly so, for its monetary madness, but at least it is the only central bank that truly analyzes the global demand for US dollars and knows that its money supply must increase a lot less than its total currency demand. In reality, the Fed QE is not unlimited, it is limited by the real demand for US currency, something that other central banks ignore or prefer to forget. Can the US dollar lose its global reserve position? Sure it can, but never to a country that decides to commit the same monetary follies as the Fed without their analysis of real demand for the currency they manage.

This should be a lesson for all countries. If you fall into the trap of playing reserve currency and endless printing without understanding demand, your US dollar dependence will intensify.

Commenti

Posta un commento