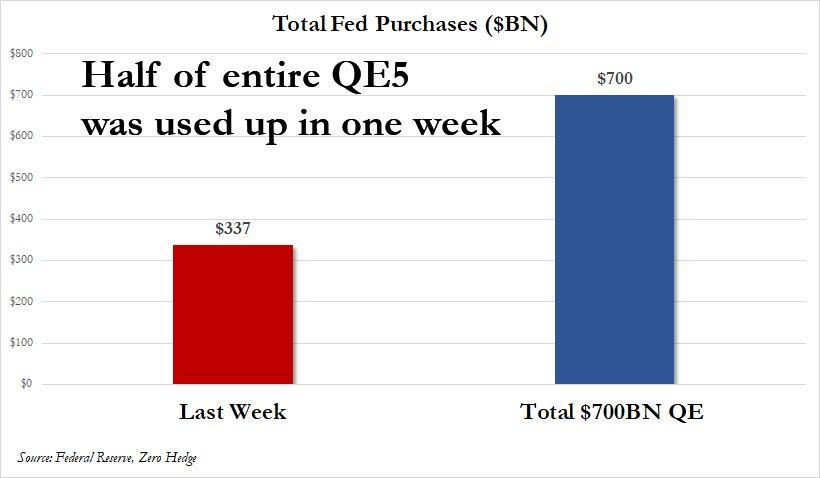

Coming into Monday, the Fed had a problem: it had already used up half of its entire emergency $700BN QE5 announced last weekend.

Which, together with the plunge in stocks, is why at 8am on Monday, just as we expected - given the political cover they have been provided - The Fed unveiled an unprecedented expansion to its mandate, announcing open-ended QE which also gave it the mandate to buy corporates bonds (in the primary and secondary market) to unclog the frozen corporate bond market as we just one step away from a full Fed nationalization of the market (only Fed stock purchases remain now).

As noted elsewhere, the Fed's new credit facilities carry limits on paying dividends and making stock buybacks for firms that defer interest payments, but have no explicit restrictions preventing beneficiaries from laying off workers.

Additionally, in addition to Treasuries, The Fed will buy Agency Commercial MBS all in unlimited size.

The Fed will buy Treasuries and agency mortgage-backed securities "in the amounts needed to support smooth market functioning and effective transmission of monetary policy to broader financial conditions and the economy," and will also buy agency commercial mortgage-backed securities, according to a statement.

The Fed also said it will support "the flow of credit to employers, consumers and businesses by establishing new programs that, taken together, will provide up to $300 billion in new financing." It will be backed by $30 billion from the Treasury's Exchange Stabilization Fund.

Coincidentally, this unprecedented action takes place just hours after real estate billionaire Tom Barrack (and friend of Trump) said the U.S. commercial-mortgage market is on the brink of collapse and predicted a "domino effect" of catastrophic economic consequences if banks and government don't take prompt action to keep borrowers from defaulting.

"Loan repayment demands are likely to escalate on a systemic level, triggering a domino effect of borrower defaults that will swiftly and severely impact the broad range of stakeholders in the entire real estate market, including property and home owners, landlords, developers, hotel operators and their respective tenants and employees," he wrote.

Barrack said the impact could dwarf that of the Great Depression... and now CMBS get their bailout.

"Wow, just wow," George Rusnak, head of investment management at Wells Fargo Private Bank, told Bloomberg Television. "Hopefully you'll come out of this with some fiscal stimulus as well, and you'll be set with good growth opportunities in the long run."

But in a sign of just how unnerved investors are by the pandemic, the Fed's moves failed to spark anything beyond a brief rally in stocks and corporate bonds Monday. Stocks fell around 1.5% after trading opened in New York. Yields on 10-year U.S. Treasuries initially sank, then soared after Mnuchin warned of a deluge of new issuance, and finally slumped again, trading at 0.73% last.

Naturally, Wall Street "analysts" habitauted to getting a bailout any time stocks drop, were delighted: "This is a great step forward," said Julia Coronado the president of MacroPolicy Perspectives. "Getting to the corporate bond market was critical. A lot of people needed to be clear the QE was unconstrained."

"The Depression was about the Fed moving too slowly," said Neil Dutta, head of economics at Renaissance Macro Research in New York. "We are seeing a lot of things today. But, a slow moving Fed hasn't been one of them. That's encouraging."

The Fed also said it "expects to announce soon the establishment of a Main Street Business Lending Program to support lending to eligible small and medium-sized businesses, complementing efforts" by the Small Business Administration.

* * *

Full details below...

Federal Reserve announces extensive new measures to support the economy

The Federal Reserve is committed to using its full range of tools to support households, businesses, and the U.S. economy overall in this challenging time. The coronavirus pandemic is causing tremendous hardship across the United States and around the world. Our nation's first priority is to care for those afflicted and to limit the further spread of the virus. While great uncertainty remains, it has become clear that our economy will face severe disruptions. Aggressive efforts must be taken across the public and private sectors to limit the losses to jobs and incomes and to promote a swift recovery once the disruptions abate.

The Federal Reserve's role is guided by its mandate from Congress to promote maximum employment and stable prices, along with its responsibilities to promote the stability of the financial system. In support of these goals, the Federal Reserve is using its full range of authorities to provide powerful support for the flow of credit to American families and businesses. These actions include:

Support for critical market functioning. The Federal Open Market Committee (FOMC) will purchase Treasury securities and agency mortgage-backed securities in the amounts needed to support smooth market functioning and effective transmission of monetary policy to broader financial conditions and the economy.

The FOMC had previously announced it would purchase at least $500 billion of Treasury securities and at least $200 billion of mortgage-backed securities. In addition, the FOMC will include purchases of agency commercial mortgage-backed securities in its agency mortgage-backed security purchases.

Supporting the flow of credit to employers, consumers, and businesses by establishing new programs that, taken together, will provide up to $300 billion in new financing. The Department of the Treasury, using the Exchange Stabilization Fund (ESF), will provide $30 billion in equity to these facilities.

Establishment of two facilities to support credit to large employers – the Primary Market Corporate Credit Facility (PMCCF) for new bond and loan issuance and the Secondary Market Corporate Credit Facility (SMCCF) to provide liquidity for outstanding corporate bonds.

Establishment of a third facility, the Term Asset-Backed Securities Loan Facility (TALF), to support the flow of credit to consumers and businesses. The TALF will enable the issuance of asset-backed securities (ABS) backed by student loans, auto loans, credit card loans, loans guaranteed by the Small Business Administration (SBA), and certain other assets.

Facilitating the flow of credit to municipalities by expanding the Money Market Mutual Fund Liquidity Facility (MMLF) to include a wider range of securities, including municipal variable rate demand notes (VRDNs) and bank certificates of deposit.

Facilitating the flow of credit to municipalities by expanding the Commercial Paper Funding Facility (CPFF) to include high-quality, tax-exempt commercial paper as eligible securities. In addition, the pricing of the facility has been reduced.

In addition to the steps above, the Federal Reserve expects to announce soon the establishment of a Main Street Business Lending Program to support lending to eligible small-and-medium sized businesses, complementing efforts by the SBA.

The PMCCF will allow companies access to credit so that they are better able to maintain business operations and capacity during the period of dislocations related to the pandemic. This facility is open to investment grade companies and will provide bridge financing of four years. Borrowers may elect to defer interest and principal payments during the first six months of the loan, extendable at the Federal Reserve's discretion, in order to have additional cash on hand that can be used to pay employees and suppliers. The Federal Reserve will finance a special purpose vehicle (SPV) to make loans from the PMCCF to companies. The Treasury, using the ESF, will make an equity investment in the SPV.

The SMCCF will purchase in the secondary market corporate bonds issued by investment grade U.S. companies and U.S.-listed exchange-traded funds whose investment objective is to provide broad exposure to the market for U.S. investment grade corporate bonds. Treasury, using the ESF, will make an equity investment in the SPV established by the Federal Reserve for this facility.

Under the TALF, the Federal Reserve will lend on a non-recourse basis to holders of certain AAA-rated ABS backed by newly and recently originated consumer and small business loans. The Federal Reserve will lend an amount equal to the market value of the ABS less a haircut and will be secured at all times by the ABS. Treasury, using the ESF, will also make an equity investment in the SPV established by the Federal Reserve for this facility. The TALF, PMCCF and SMCCF are established by the Federal Reserve under the authority of Section 13(3) of the Federal Reserve Act, with approval of the Treasury Secretary.

These actions augment the measures taken by the Federal Reserve over the past week to support the flow of credit to households and businesses. These include:

The establishment of the CPFF, the MMLF, and the Primary Dealer Credit Facility;

The expansion of central bank liquidity swap lines;

Steps to enhance the availability and ease terms for borrowing at the discount window;

The elimination of reserve requirements;

Guidance encouraging banks to be flexible with customers experiencing financial challenges related to the coronavirus and to utilize their liquidity and capital buffers in doing so;

Statements encouraging the use of daylight credit at the Federal Reserve.

Taken together, these actions will provide support to a wide range of markets and institutions, thereby supporting the flow of credit in the economy.

The Federal Reserve will continue to use it full range of tools to support the flow of credit to households and businesses and thereby promote its maximum employment and price stability goals.

* * *

So it seems The Fed's "infinite" balance sheet is being put to use, as Kashkari said they would, never mind the consequences...

"This is literally why Central Banks exist. We're the lender of last resort. This is literally why Central Banks exist. If everybody gets scared at the same time and they demand their money back, that's why the Federal Reserve is here. We will absolutely meet those demands."

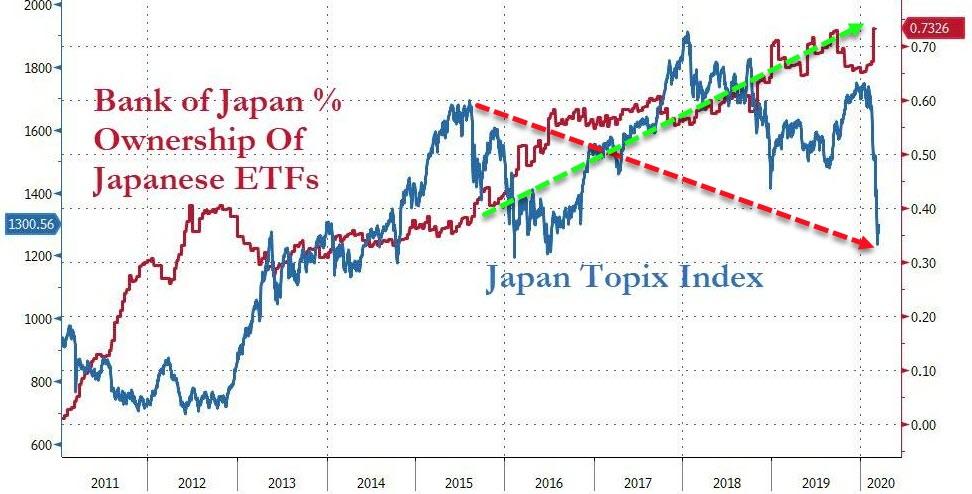

Finally, remember just a month ago, Janet Yellen suggested that The Fed should buy stocks in the next crisis.

We wonder how long before that is added to The Fed's mandate explicitly? Of course, buying stocks worked out really well for The Bank of Japan which now faces trillions in losses on its insane ETF buying program.

So, do we go full-Einsteinian-madness - repeating the mistakes (that have not worked at all) of Japan and Europe and expect a different result, or is now the time to bite the bullet, peel off the bandaid, liquidate what has failed and - at the cost of massive political upheaval - embrace the creative destruction and prepare for a new world?

Commenti

Posta un commento