Michael Levitt, a Nobel laureate and Stanford biophysicist, said earlier this week that the COVID-19 pandemic could be nearing an end as he cited China's curve flattening to support his hypothesis. Other experts have said there is no clear endpoint, and the virus crisis could be around for months, or even years.

So, the trillion-dollar question: Who should we believe?!

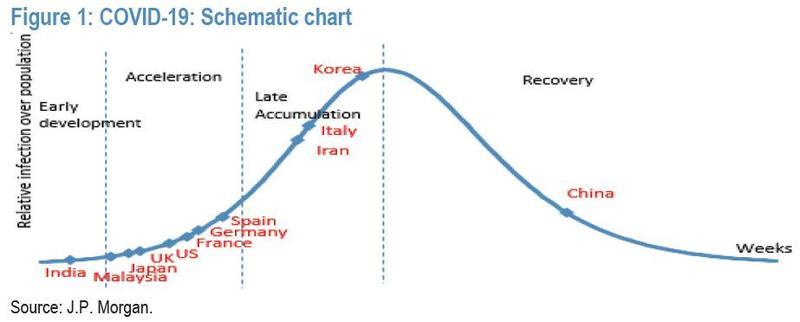

One positive step in slowing down the spread is the shutdown of the global economy. Strict social distancing measures, mass quarantines, and travel bans across the world has flattened the curve in China, with decelerating cases and deaths seen in Italy, Iran, and South Korea.

Then the rest of Europe, with Spain, Germany, France, the UK, are all experiencing accelerating cases that will likely get worse in the weeks ahead.

And, the bad news: both the US and India are at the very start of the curve and things will deteriorate in the weeks ahead before they get better.

So clearly, the pandemic will be sticking around for the next several months. Prime Minister Boris Johnson believes the UK, which is in the early part of the acceleration phase, could see the outbreak peak within the next 12 weeks.

BBC News notes that it could "take a long time for the tide to go out," referencing that the virus crisis in the UK could be around for quite some time:

It is clear the current strategy of shutting down large parts of society is not sustainable in the long-term. The social and economic damage would be catastrophic.

What countries need is an "exit strategy" - a way of lifting the restrictions and getting back to normal.

But the coronavirus is not going to disappear.

If you lift the restrictions that are holding the virus back, then cases will inevitably soar.

Mark Woolhouse, a professor of infectious disease epidemiology at the University of Edinburgh, said there's no clear "exit strategy" for how countries eradicate COVID-19.

"It's not just the UK, no country has an exit strategy," Woolhouse said.

To fully eradicate the fast-spreading virus from a country, there needs to be a vaccine, and with one 12-18 months away, this suggests that lockdowns could become the norm this year, and maybe into next.

"Waiting for a vaccine should not be honoured with the name 'strategy,' that is not a strategy," he added

Prof Neil Ferguson from Imperial College London said it could take several years for people in the UK to build up a natural immunity to the virus:

"So eventually, if we continued this for two-plus years, maybe a sufficient fraction of the country at that point might have been infected to give some degree of community protection."

Woolhouse said while the world waits for a vaccine, there could be "permanent changes in our behavior that allow us to keep transmission rates low."

Countries across Europe, the Americas, and Asia have no exit strategy, at the moment, to fully eradicate COVID-19, and this is concerning because even if social distancing and quarantines are lifted in some regions, the fast-spreading virus could resurface in waves, sort of like what happened with the Spanish Flu over a century ago.

So, until there's a vaccine, people of the world should get used to "Netflix and quarantine."

Commenti

Posta un commento