In the aftermath of the great Commercial Paper panic of 2020, which erupted over the past two weeks when initially the Fed failed to launch a Commercial Paper backstop facility, something it did with a two day delay on Tuesday, countless blue chip (and less than clue chip) companies found themselves with gaping liquidity shortfalls, and to bridge their funding needs, they rushed to draw on their existing credit facilities (also a hedge in case the banking system imposes a lending moratorium similar to what happened in the 2008 crash).

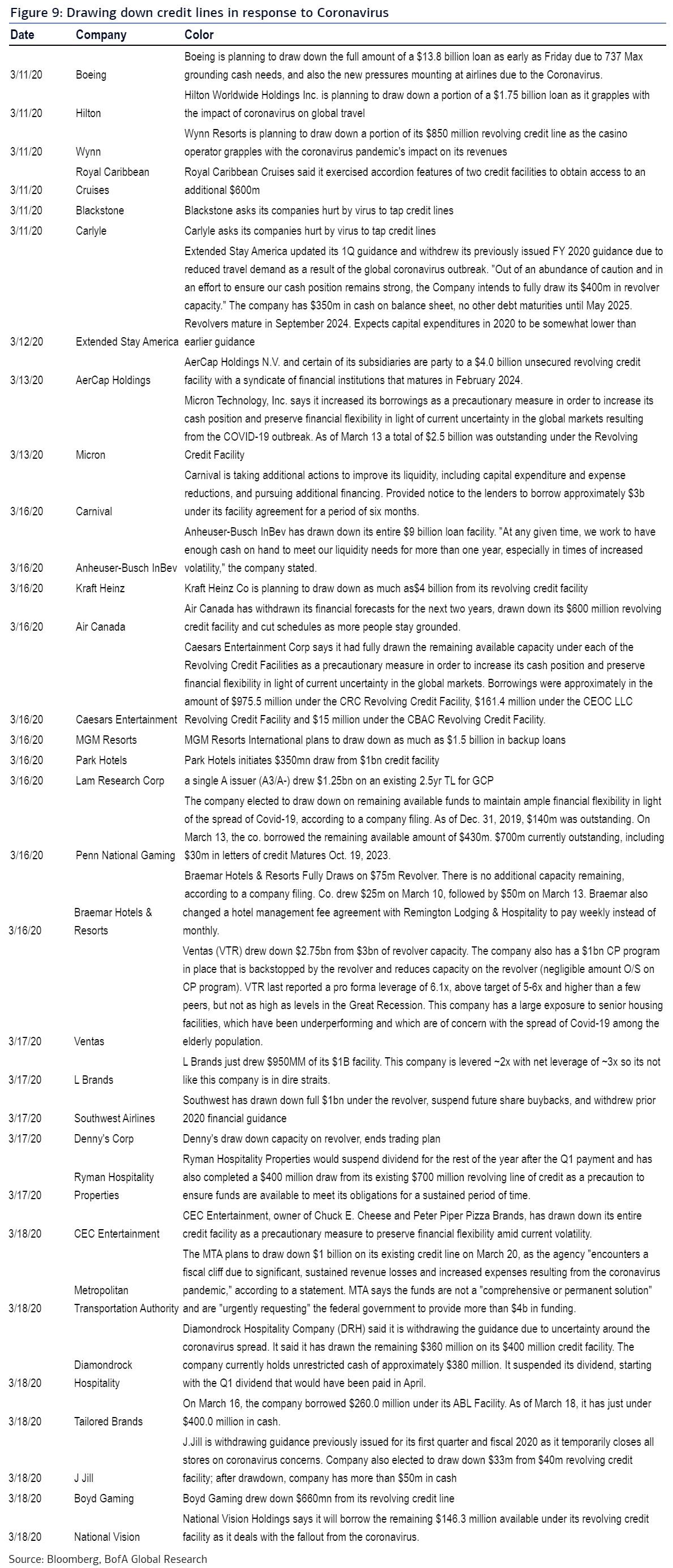

As a result, corporate borrowers worldwide, including Boeing, Hilton, Wynn, Kraft Heinz and dozens more, drew about $60 billion from revolving credit facilities this week in a frantic dash for cash as liquidity tightens.

On Wednesday alone, another seven more companies - CEC Entertainment, Metropolitan Transportation Authority, Diamondrock Hospitality, Tailored Brands, J Jill, Boyd Gaming, and National Vision - announced intentions to draw down credit lines.

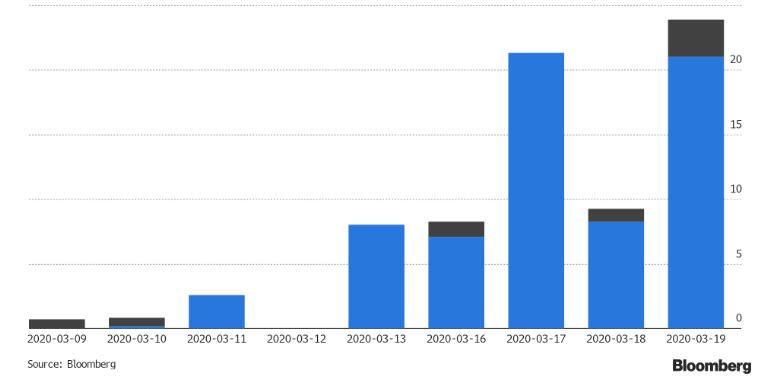

As of Friday morning, the week recorded $58BN of drawdowns, more than a five-fold jump from the $11BN for the whole of the previous week, according to Bloomberg data. The total drawdown would bring the utilization ratio above 24%, double from the 12% as of 4Q19 for US Investment Grade companies.

Thursday alone saw $21BN of facilities drawn, just short of the $21.3BN recorded on Tuesday, with Ford ($15.4BN), Kohl's ($1BN), TJX ($1BN) and Ross Stores leading the revolving charge.

What is concerning is that despite the Fed's CP backstop, companies continue to draw down on revolvers, whether because the rate on their CP is too high, or they simply do not trust banks.

The BofA table below summarizes all the companies that have drawn down on their revolver in response to the the Global Corona/Crude Crisis...

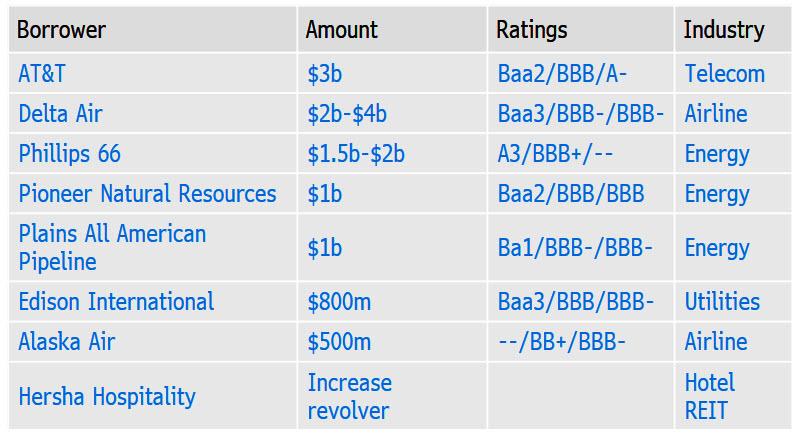

... and here is pipeline of upcoming deals, via Bloomberg.

Commenti

Posta un commento