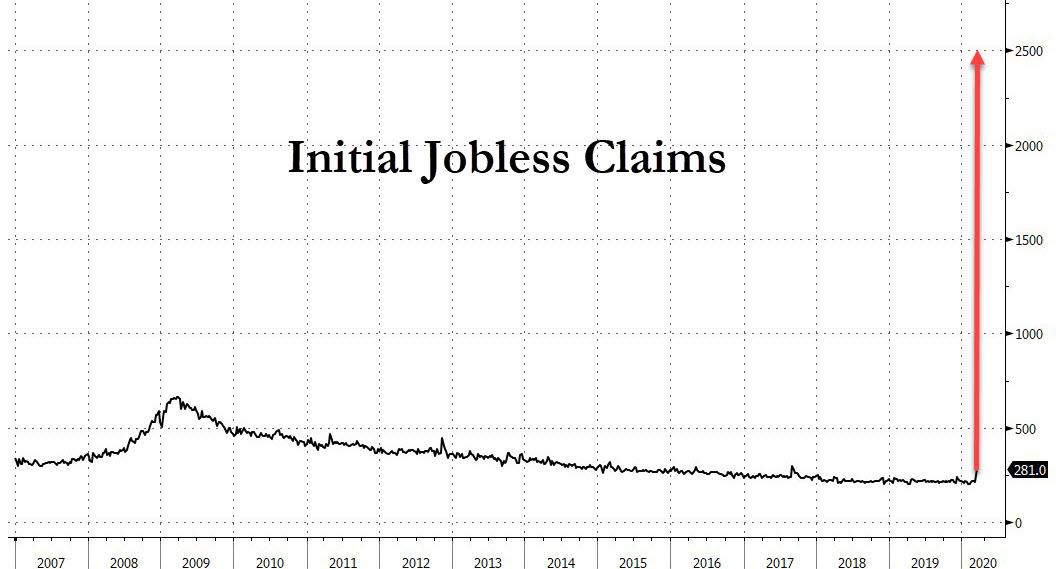

Last week's initial claims print, which surged to 281K from a recent baseline of about 220K, while bad was nowhere near the apocalyptic prints some strategists had predicted in light of the massive closures of restaurants, retailers, lodgings, and virtually all other service establishments which have shuttered for the duration of the coronavirus pandemic.

Indeed, many now think that last week's print was "low" only because the real hit was deferred to tomorrow due to processing delays and other logistical issues (countless labor department websites are only sporadically online amid the surge in traffic).

And while looking at tomorrow's initial claims report reveals a historic surge in Wall Street expectations, with consensus now expecting up to 750K newly laid-off workers seeking benefits, according to Southbay, historically one of the most accurate labor market forecasters, tomorrow's print will be a whopper at no less than 2.5 million!

Prior Week Initial Claims (Actual): 281K

Current Week Claims Forecast (Consensus): 750K

Current Week Claims Forecast (SouthBay): 2,351K

Here is SouthBay Research answering the question "How many people have been laid off?"

Consider theme parks: Disneyland shut last week and they employ ~25K. Disney World the same.

Or restaurants: There are 660K restaurants in the US. Of which 300K+ are full service restaurants (FSR): wait staff, host staff, bussers, dishwashers. According to the BLS, FSRs employ ~5.5M workers.

Basically it's hard not to see 1M+ layoffs in dining & drinking establishments. (Barely 8% of the total Food & Drinking labor base). If each FSR lays off 1 waiter and 1 support staff, that alone is 600K.

Michigan reported 55k claims in the 1st 3 days of the week; that's 15x the normal week total.

SouthBay's Model

The SouthBay data shows a 66% y/y drop in hiring (-44% week-over-week), with the heaviest concentration in...restaurants. In 2009, when Jobless Claims were surging at a comparable rate, they were running at 600K Initial Claims per week. But we didn't have complete shutdowns then.

The number will be slightly lower than actual because of late filings and government processing (the scale will be more than can be handled).

And visually:

2.5 Million Initial Jobless Claims Tomorrow?

is what the initial claims chart will look like if SouthBay is right.

Confirming that tomorrow will be a bloodbath, is the latest commentary from Larry Kudlow who just said on Fox News that the upcoming jobs report will show a "large increase" in unemployment claims.

"It's going to be a very big increase, everybody in the market knows that."

Of course, the question is how large.

Finally, if not this week, the next will certainly be a shocker, and here's why:

- CA GOV: 1 MILLION IN STATE HAVE FILED JOBLESS CLAIMS THIS MONTH

Commenti

Posta un commento