But by 'Main St.' it doesn't mean consumers or households. It means that virtually any capitalist financial enterprise that has bad debt it can now dump it on the Fed.

In their announcement of its latest 'lending facility', as it is called, the Fed declared it would 'support' small business loans, student loans, auto securitized loans, and credit card debt. But that does not mean the Fed will 'support' consumers and assume their loans.

Oh no!

It means it will support the financial lenders making such loans for students, auto purchases, credit cards and small businesses.

It means these lenders can now dump their bad, defaulted, or otherwise non-performing debt from credit cards, auto loans, student or small business loans on the Fed. The Fed will eat it for them, and add it to the Fed's own $4 trillion plus indebted balance sheet–soon to rise to $8 trillion or more

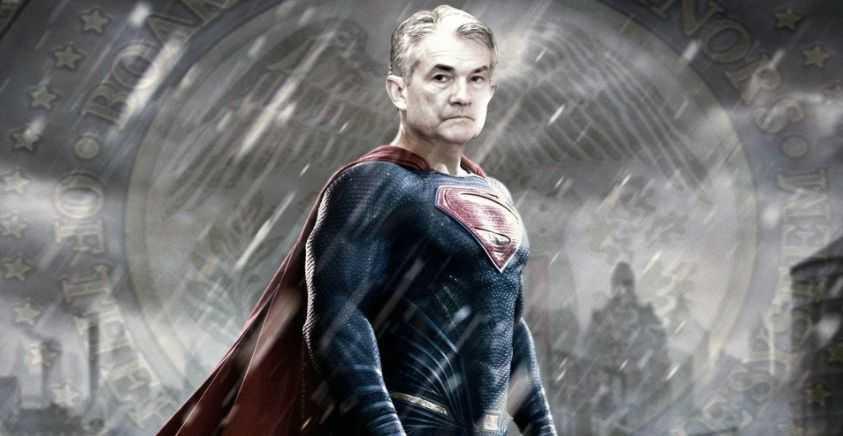

I propose therefore we erect a new Statue of Money Capital on the steps in front of the Federal Reserve building in Washington D.C. A companion to the Statue of Liberty in the New York harbor. And on it we should inscribe the following motto:

"Give me your busted financial speculators, your bankrupt businesses, your huddled hedge funds yearning for guaranteed high yield. The wretched of your banking system. Send me your former millionaires with now empty accounts and I will make them whole again. I lift my greenback lamp beside my free money door. Come in and get what you want!"

What are markets for at all if The Fed now backstops everthing?

Commenti

Posta un commento